Accounting ERP stands as the bedrock of modern financial operations, acting as the central nervous system for a business’s financial data. It’s more than just software; it’s an integrated ecosystem designed to streamline, manage, and optimize every facet of financial activity. From the initial entry of a transaction to the final, polished financial report, an accounting ERP system orchestrates a complex dance of data, ensuring accuracy, efficiency, and unparalleled visibility.

This comprehensive guide delves into the fundamental role of integrated financial management systems, exploring how an accounting Enterprise Resource Planning system serves as the central nervous system for financial data. We will dissect the core modules, trace the conceptual flow of financial transactions, and highlight the inherent advantages of a unified platform. Furthermore, we’ll navigate the critical process of selecting the right accounting ERP solution, comparing deployment options, identifying essential features, and emphasizing the importance of vendor support.

The subsequent sections will focus on optimizing business processes through strategic implementation, including streamlining workflows, integrating with other applications, and ensuring data integrity during migration. Finally, we will explore how advanced accounting ERP capabilities enhance financial visibility and decision-making, while also looking ahead to the future trajectory of these transformative technologies.

The Fundamental Role of Integrated Financial Management Systems in Modern Business Operations

In today’s fast-paced business environment, efficiency, accuracy, and real-time visibility into financial operations are paramount for success. Integrated financial management systems, often embodied by Accounting Enterprise Resource Planning (ERP) solutions, have transitioned from being mere accounting tools to becoming the indispensable backbone of modern business operations. These systems are designed to streamline and automate a wide array of financial processes, providing a unified platform that fosters better decision-making, enhances compliance, and drives overall business growth.

The ability to connect disparate financial data points into a cohesive whole allows organizations to move beyond reactive reporting to proactive strategic planning, a critical differentiator in competitive markets.An Accounting ERP system functions as the central nervous system for an organization’s financial data, orchestrating the flow of information across various departments and functions. It acts as a single source of truth, eliminating data silos and ensuring consistency and accuracy in financial reporting.

Unlike traditional, fragmented accounting software, an ERP system integrates all financial modules, from accounts payable and receivable to general ledger, budgeting, and financial reporting, into a single, cohesive database. This integration means that a transaction entered in one module is immediately reflected across all relevant modules, providing an up-to-the-minute view of the company’s financial health. This real-time visibility is crucial for management to make informed decisions, identify potential issues early, and capitalize on emerging opportunities.

For instance, a sales order entered in the sales module automatically triggers entries in the accounts receivable and inventory modules, updating cash flow projections and stock levels simultaneously. This interconnectedness prevents the delays and errors often associated with manual data transfer between separate systems, leading to improved operational efficiency and reduced risk. Furthermore, by standardizing financial processes and controls, an Accounting ERP system enhances internal controls and facilitates compliance with regulatory requirements, such as Sarbanes-Oxley (SOX) or International Financial Reporting Standards (IFRS).

The system’s ability to track audit trails and provide detailed transaction histories is invaluable for both internal and external audits, bolstering transparency and accountability.

Core Modules within an Accounting ERP System and Their Interconnectedness

The architecture of an Accounting ERP system is built upon a foundation of interconnected core modules, each designed to manage specific financial functions. The seamless integration of these modules is what empowers the system to act as a unified financial hub. Understanding these components and how they interact is key to appreciating the power of an ERP.Typically, an Accounting ERP system comprises the following core modules:

- General Ledger (GL): This is the central repository for all financial transactions. It records all debits and credits, providing a summary of the company’s financial position. All other modules feed data into the GL, ensuring that it always reflects the most current financial status.

- Accounts Payable (AP): This module manages all outgoing payments to vendors and suppliers. It handles invoice processing, payment scheduling, and vendor management. When an invoice is approved in AP, it creates a liability in the GL and affects cash flow projections.

- Accounts Receivable (AR): This module manages all incoming payments from customers. It handles invoice generation, payment tracking, and credit management. When a payment is received and applied in AR, it updates the GL and impacts cash balances.

- Fixed Assets Management: This module tracks and manages an organization’s long-term tangible assets, including depreciation calculations and disposal. Depreciation entries generated here are posted to the GL, impacting the asset’s book value and the company’s expenses.

- Cash Management/Treasury: This module provides oversight of cash balances across all bank accounts, manages bank reconciliations, and forecasts cash flow. It draws data from AP and AR to provide accurate cash flow insights.

- Budgeting and Forecasting: This module allows for the creation and management of financial budgets and the generation of future financial projections. These budgets are then used to compare against actual performance reported in the GL, highlighting variances.

- Financial Reporting and Analytics: This module generates various financial statements, such as balance sheets, income statements, and cash flow statements, based on the data residing in the GL. It also provides tools for in-depth financial analysis and business intelligence.

The interconnectedness is the defining characteristic. For example, when a sales order is finalized and shipped, the AR module automatically generates an invoice, and the GL is updated with the revenue and accounts receivable. Simultaneously, if inventory is managed within the ERP, the inventory module would be updated to reflect the reduction in stock. This cascading effect ensures that financial data is consistent and up-to-date across the entire system, enabling comprehensive and accurate financial reporting.

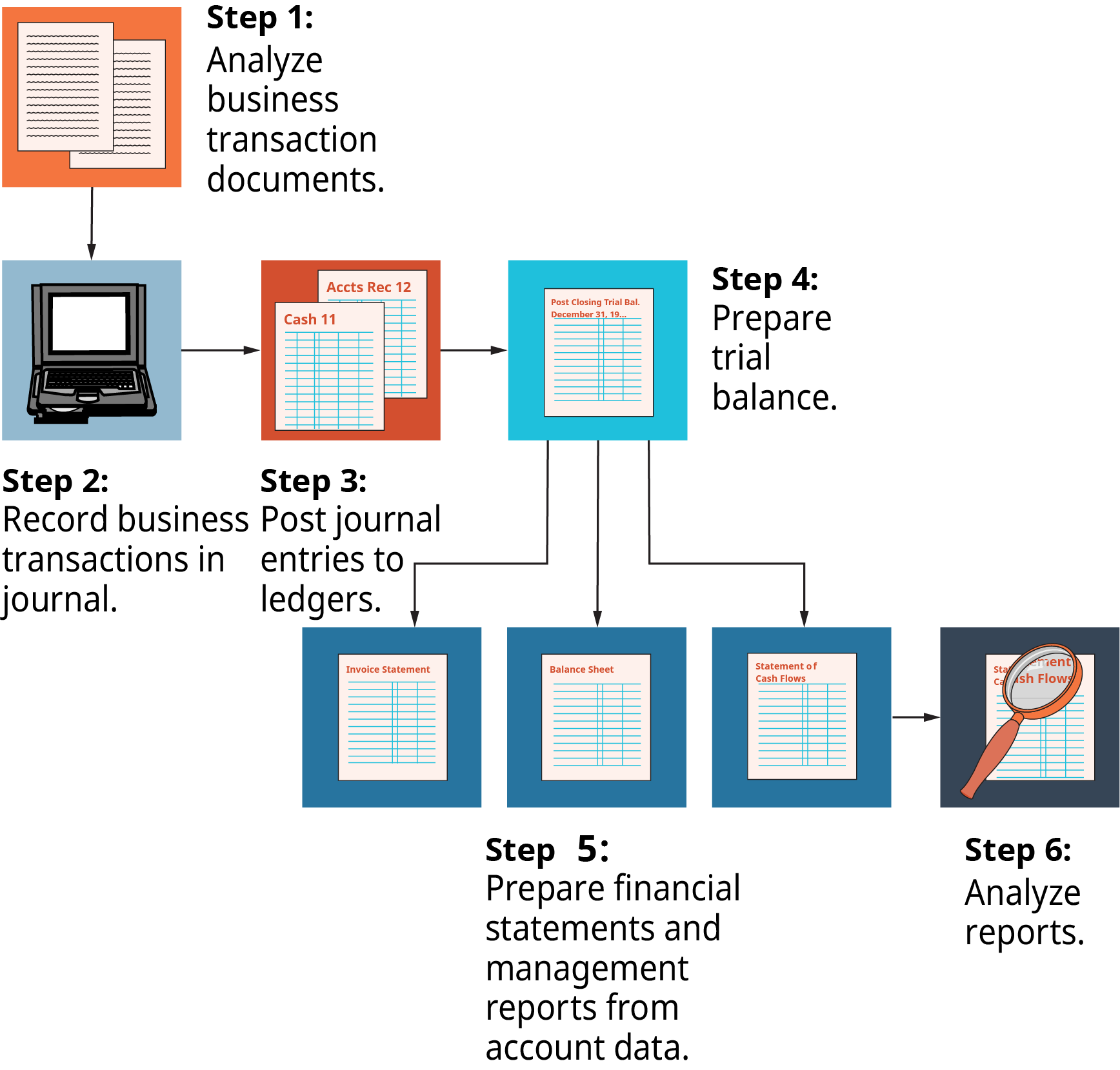

Conceptual Flow of Financial Transactions within an ERP Environment

The journey of a financial transaction within an Accounting ERP system is a well-defined and automated process, moving from its initial capture to its final aggregation into comprehensive financial reports. This structured flow is what ensures accuracy, auditability, and real-time visibility.Consider the lifecycle of a typical vendor invoice:

- Invoice Entry: A vendor invoice is received by the accounts payable department. It is entered into the Accounts Payable module of the ERP system. Key details such as vendor name, invoice number, date, amount, and due date are recorded. Supporting documentation, like purchase orders and receiving reports, can often be attached digitally within the system.

- Approval Workflow: Once entered, the invoice typically enters an automated approval workflow. Depending on the invoice amount and the department responsible, it is routed electronically to the appropriate managers or budget holders for review and authorization. This workflow ensures that only legitimate and approved expenses are processed.

- Posting to General Ledger: Upon final approval, the invoice is posted. This action creates a journal entry that is simultaneously recorded in the General Ledger. The entry will typically debit an expense or asset account and credit the Accounts Payable liability account. This is where the transaction officially becomes part of the company’s financial records.

- Payment Processing: At the appropriate time, usually based on the due date, the invoice is selected for payment. The system generates a payment batch, which can be processed through various methods, including checks, electronic funds transfers (EFTs), or other payment gateways.

- Cash Disbursement and GL Update: When the payment is executed, the system records the cash disbursement. This updates the General Ledger by debiting the Accounts Payable liability account (reducing the outstanding debt) and crediting the relevant bank account (reducing cash on hand).

- Reconciliation: The system’s cash management module then facilitates bank reconciliation by comparing the ERP’s records of cash transactions with the bank statements. Any discrepancies are flagged for investigation.

- Reporting: Throughout this process, the data resides in the central database. The financial reporting module can then access this real-time data to generate up-to-the-minute reports. This includes the Accounts Payable aging report, cash flow statements, and the overall financial statements like the balance sheet and income statement, which reflect the impact of the processed invoice and payment.

This conceptual flow illustrates how a single event, the vendor invoice, triggers a series of integrated actions across multiple modules, culminating in accurate financial reporting. Each step is logged, creating a transparent audit trail.

Inherent Advantages of a Unified Platform for Managing Diverse Accounting Functions

The adoption of a unified platform for managing diverse accounting functions, as provided by an Accounting ERP system, yields a multitude of inherent advantages that significantly enhance an organization’s operational efficiency, financial accuracy, and strategic capabilities. Moving away from disparate, often manual, systems to a single, integrated solution transforms how a business manages its financial operations.The advantages are substantial and far-reaching:

- Enhanced Data Accuracy and Consistency: With all financial data residing in a single database, the risk of data duplication, manual entry errors, and inconsistencies across different departments is drastically reduced. This single source of truth ensures that everyone is working with the same, reliable information, leading to more accurate financial statements and reports.

- Real-Time Financial Visibility: A unified platform provides immediate access to financial data as it is generated. This real-time visibility allows management to monitor financial performance, identify trends, and make proactive decisions without waiting for periodic batch processing or manual report compilation. For example, a business can see its current cash position at any moment, enabling better management of liquidity.

- Improved Operational Efficiency: Automation of routine tasks, such as invoice processing, payment scheduling, and report generation, frees up accounting staff to focus on more strategic activities like financial analysis and business planning. Workflows can be standardized, reducing processing times and bottlenecks.

- Streamlined Compliance and Audit Trails: Integrated systems inherently provide robust audit trails, documenting every transaction from entry to final posting. This makes it significantly easier to comply with regulatory requirements, respond to audits, and maintain internal controls. The ability to track who did what, when, and why is invaluable.

- Better Decision-Making: Access to comprehensive, accurate, and timely financial data empowers better-informed decision-making at all levels of the organization. Managers can analyze financial performance against budgets, identify profitable areas, and pinpoint inefficiencies with greater confidence.

- Reduced Costs: While the initial investment in an ERP system can be significant, the long-term cost savings are substantial. These savings come from reduced manual labor, fewer errors, improved inventory management (if applicable), better cash flow management, and optimized resource allocation.

- Scalability and Flexibility: Modern Accounting ERP systems are designed to scale with the business. As an organization grows, the system can accommodate increased transaction volumes, new business units, and evolving financial requirements without needing to replace the entire system.

For instance, a retail company using an integrated ERP can see the real-time sales performance of each store, which directly impacts inventory levels, accounts receivable, and overall profitability. This holistic view allows for agile responses to market changes and operational challenges.

Navigating the selection process for an appropriate accounting Enterprise Resource Planning solution.

Selecting the right accounting Enterprise Resource Planning (ERP) solution is a pivotal decision for any business aiming to streamline its financial operations and drive growth. It’s not a one-size-fits-all scenario; rather, it requires a thoughtful, systematic approach to ensure the chosen system aligns perfectly with the company’s unique needs and future aspirations. This involves a deep dive into understanding what the business truly requires, followed by a thorough evaluation of available software options.The process of selecting an accounting ERP is akin to building a house; you wouldn’t start laying bricks without a solid blueprint.

Therefore, a structured approach to defining requirements is paramount. This ensures that the eventual ERP system isn’t just a collection of features but a strategic tool that addresses specific pain points and unlocks new efficiencies. Without this foundational step, businesses risk investing in a solution that falls short of expectations, leading to wasted resources and operational disruptions.

Step-by-Step Guide to Identifying Specific Business Requirements

Before even glancing at software vendor brochures or demos, a business must meticulously define its specific needs. This involves a cross-departmental effort to capture the full spectrum of financial and operational processes that an ERP system is intended to support. A structured approach ensures all critical areas are considered, preventing oversight and later complications.Here’s a step-by-step guide to effectively identify these requirements:

- Form a Dedicated Selection Team: Assemble a team comprising key stakeholders from finance, accounting, operations, sales, and IT. This ensures diverse perspectives and a comprehensive understanding of how different departments interact and rely on financial data. The team should be responsible for leading the entire selection process.

- Document Current Processes and Pain Points: Thoroughly map out all existing financial and accounting workflows, from accounts payable and receivable to general ledger management, budgeting, and financial reporting. For each process, identify current inefficiencies, bottlenecks, manual workarounds, and areas causing frustration or errors. This forms the basis for understanding what needs improvement.

- Define Core Functional Requirements: Based on the documented processes, list the essential functionalities the ERP system must possess. This includes core accounting modules like general ledger, accounts payable, accounts receivable, fixed assets, and cash management. Also, consider needs related to budgeting, forecasting, cost accounting, and tax management.

- Identify Integration Needs: Determine which other business systems the accounting ERP needs to integrate with. This could include Customer Relationship Management (CRM) software, inventory management systems, e-commerce platforms, payroll providers, or business intelligence tools. Seamless integration is crucial for data consistency and a unified view of operations.

- Artikel Reporting and Analytics Demands: Specify the types of financial reports and analytical insights the business requires. This might include standard financial statements (balance sheet, income statement, cash flow), custom management reports, key performance indicator (KPI) dashboards, and compliance-related reporting. The ability to drill down into data for deeper analysis is often a critical requirement.

- Consider Scalability and Future Growth: Think about the company’s projected growth over the next 3-5 years. Will the ERP system be able to handle increased transaction volumes, new product lines, or expansion into new markets? The system should be scalable to accommodate future business needs without requiring a complete overhaul.

- Evaluate Compliance and Regulatory Requirements: Identify any industry-specific regulations or compliance standards that the ERP system must adhere to. This could include GAAP, IFRS, SOX, or specific data privacy laws. The system should facilitate compliance and simplify audits.

- Assess User Experience and Accessibility: While functionality is key, the system must also be user-friendly and accessible to the employees who will use it daily. Consider the interface design, ease of navigation, and availability of mobile access if required. A complex or unintuitive system can hinder adoption and reduce productivity.

By following these steps, businesses can create a detailed and prioritized list of requirements that will serve as a robust foundation for evaluating and selecting the most suitable accounting ERP solution.

Cloud-Based vs. On-Premises ERP Deployments

The deployment model of an accounting ERP system is a fundamental decision that significantly impacts cost, IT infrastructure, security, and flexibility. Businesses must carefully consider their operational model, IT capabilities, and budget when deciding between cloud-based and on-premises solutions. Each model offers distinct advantages and disadvantages, making one potentially more suitable than the other depending on the specific business context.Cloud-based ERP solutions are hosted on the vendor’s servers and accessed over the internet.

This model, often referred to as Software as a Service (SaaS), offers several compelling benefits, particularly for small to medium-sized businesses (SMBs) and rapidly growing companies. The primary advantage is the reduced upfront investment, as there’s no need to purchase and maintain expensive hardware or servers. Instead, businesses typically pay a recurring subscription fee, which often includes maintenance, updates, and support.

This predictable cost structure can be very attractive for budget-conscious organizations. Furthermore, cloud ERPs offer high scalability; resources can be easily adjusted up or down based on demand, allowing businesses to adapt quickly to changing needs without significant infrastructure changes. Accessibility is another major plus, as users can access the system from anywhere with an internet connection, facilitating remote work and collaboration.

The vendor is responsible for security, backups, and disaster recovery, often employing robust measures that may surpass what an individual company could implement. However, reliance on internet connectivity is a critical consideration; an outage can disrupt access. Customization options can sometimes be more limited compared to on-premises solutions, and data security, while generally strong, remains a concern for some businesses with highly sensitive data or stringent regulatory requirements.On-premises ERP deployments, conversely, involve installing and running the software on a company’s own servers and IT infrastructure.

This model grants businesses complete control over their data and the system’s environment. For organizations with strict data security policies, highly specific customization needs, or a robust in-house IT department capable of managing complex systems, on-premises can be the preferred choice. The upfront cost is typically higher due to the purchase of hardware, software licenses, and the cost of implementation and ongoing IT maintenance.

However, over the long term, for very large enterprises with stable needs, the total cost of ownership might be comparable or even lower than a perpetual cloud subscription, as there are no recurring license fees. Customization is generally more extensive with on-premises solutions, allowing businesses to tailor the system precisely to their unique workflows. Data resides within the company’s own network, providing a sense of security and control.

The main drawbacks include the significant capital expenditure, the ongoing burden of IT management, maintenance, and upgrades, and the potential for slower adoption of new technologies. Disaster recovery and security are entirely the responsibility of the business, requiring dedicated resources and expertise.Ultimately, the choice between cloud and on-premises depends on a business’s specific circumstances. Startups and SMBs often find cloud ERPs more accessible and scalable.

Mid-sized to large enterprises with complex requirements, significant IT resources, and a strong need for data control might lean towards on-premises solutions, though hybrid models are also increasingly common, offering a blend of benefits.

Critical Features Distinguishing Robust Accounting ERP Systems

The accounting ERP landscape is vast, with solutions ranging from basic accounting software to comprehensive enterprise-level systems. Distinguishing a robust accounting ERP from simpler accounting software hinges on a set of advanced features designed for integration, automation, and strategic financial management. While basic accounting software typically focuses on transactional processing and standard reporting, a true accounting ERP offers a more holistic and powerful approach to managing a company’s financial ecosystem.One of the most significant differentiators is the degree of integration.

Robust accounting ERPs are built with modules that are inherently interconnected. This means that data entered in one module, such as sales orders in a CRM or production schedules in manufacturing, automatically flows to the general ledger, accounts payable, and accounts receivable without manual re-entry. This eliminates data silos, reduces errors, and provides real-time visibility across the entire organization. Basic accounting software often operates as a standalone system or with limited, often manual, integration capabilities.Another critical feature is advanced financial planning and analysis (FP&A) capabilities.

A robust ERP goes beyond simple budgeting to offer sophisticated tools for forecasting, scenario modeling, and performance analysis. This includes features like multi-dimensional analysis, variance analysis, and the ability to create complex financial models to support strategic decision-making. Basic software might offer simple budgeting but lacks the depth for comprehensive FP&A. Automated workflows and business process management are also hallmarks of a strong accounting ERP.

This includes features like automated invoice processing, payment approvals, bank reconciliations, and purchase order workflows. These automation capabilities significantly reduce manual effort, speed up processes, minimize human error, and improve compliance. Simpler accounting software typically relies on manual steps for most of these processes.Furthermore, comprehensive inventory management and supply chain integration are often integrated into robust accounting ERPs, especially for businesses dealing with physical goods.

This allows for real-time tracking of inventory levels, cost of goods sold calculations, demand forecasting, and seamless integration with purchasing and sales. Basic accounting software usually has minimal or no inventory management capabilities. Multi-currency and multi-company support are essential for businesses operating internationally or managing multiple legal entities. A robust ERP can handle transactions in various currencies, manage exchange rate fluctuations, and consolidate financial statements from different subsidiaries.

This is typically beyond the scope of basic accounting packages.Finally, robust security, audit trails, and compliance features are paramount. A strong accounting ERP provides granular user access controls, detailed audit logs of all transactions and changes, and built-in functionalities to help meet regulatory requirements like SOX or GDPR. This level of security and traceability is often less developed in basic accounting software.In essence, while basic accounting software handles the mechanics of bookkeeping, a robust accounting ERP acts as the central nervous system for a business’s financial operations, enabling efficiency, providing deep insights, and supporting strategic growth.

Importance of Vendor Support, Training, and Implementation Services

The selection phase for an accounting ERP solution is not solely about identifying the software with the best features; it is equally, if not more, about the ecosystem surrounding that software. The vendor’s commitment to support, the quality of their training programs, and the effectiveness of their implementation services are critical determinants of the system’s ultimate success and the return on investment.

Neglecting these aspects during the selection process can lead to significant challenges down the line, including user frustration, project delays, and a failure to realize the ERP’s full potential.Vendor support is the lifeline for any business implementing and using an ERP system. During the selection phase, it’s crucial to understand the different levels of support offered. This includes:* Availability and Response Times: What are the support hours?

Is it 24/7 or limited to business hours? What are the guaranteed response times for critical issues? For businesses operating across different time zones or requiring continuous uptime, round-the-clock support is invaluable.

Support Channels

How can support be accessed? Through phone, email, a ticketing system, or a dedicated portal? A multi-channel approach often caters to different preferences and urgency levels.

Expertise of Support Staff

Are the support technicians knowledgeable about accounting principles and the specific ERP solution? The ability to resolve issues efficiently depends heavily on the expertise of the support team.

Service Level Agreements (SLAs)

For cloud-based solutions especially, understanding the SLA regarding uptime, performance, and issue resolution is vital to ensure business continuity.Training is another cornerstone of successful ERP adoption. A powerful system is ineffective if users don’t know how to leverage its capabilities. When evaluating vendors, inquire about:* Training Methodologies: Do they offer on-site training, remote sessions, e-learning modules, or a combination?

The best approach depends on the company’s size, geographical distribution of users, and learning preferences.

Customized Training

Can training be tailored to specific roles and departments within the organization? Generic training might not address the unique workflows and challenges of each user group.

Ongoing Training and Resources

What resources are available for new hires or for refreshing existing users’ knowledge? Access to updated documentation, webinars, and advanced training sessions ensures users remain proficient as the system evolves.Implementation services are arguably the most critical component, as this is where the ERP system is configured, customized, and deployed within the business. A well-managed implementation is key to a smooth transition.

Key considerations include:*

*Implementation Methodology

Does the vendor follow a structured methodology (e.g., Agile, Waterfall)? Understanding their approach helps set expectations for project phases, timelines, and deliverables.

Project Management

Who will manage the implementation project? What is their experience? A dedicated, experienced project manager from the vendor side is essential for keeping the project on track, managing scope, and mitigating risks.

Data Migration

How will historical data be migrated from the old system to the new ERP? This is often a complex and time-consuming process, and the vendor’s expertise in data cleansing and migration is crucial.

Customization and Configuration

While robust ERPs offer extensive configuration options, complex customizations can be risky. The vendor’s ability to guide these decisions, ensure they align with best practices, and provide ongoing support for them is vital.

Testing and Go-Live Support

What is the vendor’s plan for user acceptance testing (UAT) and go-live support? Ensuring thorough testing and having the vendor readily available during the critical go-live period can prevent major disruptions.Ultimately, choosing an ERP vendor is a partnership. The vendor’s commitment to providing excellent support, comprehensive training, and expert implementation services directly impacts the business’s ability to achieve its financial management goals and derive maximum value from its ERP investment.

Optimizing business processes through the strategic implementation of an accounting Enterprise Resource Planning system.

Implementing an accounting Enterprise Resource Planning (ERP) system is a pivotal step for businesses aiming to enhance efficiency, accuracy, and strategic decision-making. Beyond simply managing financial transactions, a well-integrated ERP system acts as the central nervous system of an organization, orchestrating various operational functions. This strategic adoption allows businesses to move from reactive data management to proactive process optimization, driving significant improvements across the board.

The benefits extend from day-to-day operational streamlining to long-term strategic advantage, making it an indispensable tool for modern enterprises.An accounting ERP system fundamentally redefines how businesses manage their core financial operations. It moves away from siloed departmental spreadsheets and disparate software solutions, creating a unified platform where data flows seamlessly. This integration fosters a holistic view of the business, enabling better resource allocation, risk management, and ultimately, more informed strategic planning.

The ability to automate repetitive tasks, enforce standardized procedures, and provide real-time visibility into financial performance empowers organizations to operate with greater agility and precision in today’s dynamic market.

Streamlining Accounts Payable and Accounts Receivable Workflows

The impact of an accounting ERP system on accounts payable (AP) and accounts receivable (AR) workflows is transformative, leading to significant improvements in efficiency, accuracy, and cash flow management. These modules are designed to automate and standardize processes that are often manual, time-consuming, and prone to errors. By centralizing all AP and AR activities, an ERP system provides unprecedented control and visibility, enabling businesses to optimize their financial operations and reduce operational costs.For accounts payable, an ERP system automates the entire procure-to-pay cycle.

This begins with the automated capture of vendor invoices, often through optical character recognition (OCR) technology, which reduces manual data entry and minimizes the risk of duplicate payments or data entry errors. Once an invoice is captured, the system can automatically match it against purchase orders and goods receipts, flagging any discrepancies for immediate review. Approval workflows are digitized and enforced, ensuring that invoices are routed to the correct personnel for authorization according to predefined rules.

Payment processing is then streamlined, allowing for batch payments, electronic fund transfers (EFTs), and optimized payment scheduling to take advantage of early payment discounts while managing cash outflow effectively. The system also provides real-time visibility into outstanding liabilities, vendor aging, and payment history, facilitating better vendor relationship management and improved negotiation power. For instance, a retail company might use an ERP to automatically process thousands of invoices from suppliers, ensuring timely payments to secure favorable terms and avoid stockouts, thereby directly impacting their operational continuity and profitability.Similarly, accounts receivable processes are significantly enhanced.

The ERP system automates invoice generation and distribution, reducing manual effort and ensuring timely billing. It offers robust tools for credit management, allowing businesses to set credit limits, monitor customer payment histories, and manage credit applications efficiently. Cash application is streamlined through automated matching of incoming payments to outstanding invoices, often using bank reconciliation features. This reduces the time spent on manual reconciliation and minimizes the risk of misapplied payments.

Dunning processes are automated with configurable reminder schedules and communication templates, helping to reduce days sales outstanding (DSO) and improve collection rates. The system also provides detailed aging reports, customer statements, and cash flow forecasts, offering a clear picture of incoming revenue and enabling proactive management of potential collection issues. A B2B service provider, for example, can leverage an ERP to automate invoicing for recurring services, track client payments, and send automated reminders for overdue accounts, significantly improving their cash conversion cycle and reducing bad debt.

The integration of these modules ensures that financial data is accurate and up-to-date, providing a solid foundation for informed decision-making regarding cash flow, working capital, and overall financial health.

Integrating an ERP System with Other Critical Business Applications

Integrating an accounting ERP system with other essential business applications is crucial for creating a unified, efficient, and data-driven operational ecosystem. This integration breaks down data silos, eliminates redundant data entry, and provides a single source of truth across the organization. The goal is to ensure that information flows seamlessly between systems, enabling real-time visibility and supporting more informed, strategic decision-making.

A well-executed integration plan is key to maximizing the return on investment for both the ERP and the connected applications.A structured approach to integration typically begins with a thorough assessment of existing systems and their data structures. This involves identifying all critical business applications that need to connect with the ERP, such as Customer Relationship Management (CRM), inventory management, supply chain management (SCM), human resources (HR), and e-commerce platforms.

The next step is to define the integration strategy, which can involve various methods like direct point-to-point integrations, middleware solutions (like Enterprise Service Buses or integration platforms as a service – iPaaS), or API-based integrations. The choice of method often depends on the complexity of the systems, the volume of data, the required real-time capabilities, and the IT infrastructure. For example, integrating an ERP with a CRM system is vital for sales and finance alignment.

When a sales deal is closed in the CRM, the relevant customer and order information should automatically populate the ERP to generate an invoice and update customer credit limits. This ensures that sales forecasts are aligned with financial projections and that billing is initiated promptly.Inventory management integration is another critical area. Connecting the ERP to an inventory system ensures that stock levels are accurately reflected in financial statements and that purchasing decisions are based on real-time inventory data.

When stock is depleted, the ERP can trigger automated reorder points, which then feed into the purchasing module of the ERP itself or an SCM system. This prevents stockouts, reduces carrying costs, and optimizes the supply chain. For instance, a manufacturing company would benefit immensely from real-time synchronization between its production planning module in the ERP and its shop floor control system, ensuring that materials are procured only when needed and that finished goods inventory is accurately tracked.

E-commerce integration allows for direct transfer of online orders into the ERP for fulfillment and invoicing, while also updating product availability on the website. This seamless flow of information from online storefront to back-office operations is essential for businesses with a strong online presence.Finally, a robust integration plan includes thorough testing, ongoing monitoring, and a clear governance strategy. Pilot testing with a subset of data and users is essential to identify and resolve any issues before a full rollout.

Post-implementation, continuous monitoring of data flows and system performance is necessary to ensure that integrations remain stable and effective. Establishing clear ownership and maintenance procedures for each integration point will ensure long-term success and adaptability to future system upgrades or changes. The objective is to create a cohesive digital backbone that supports operational efficiency and provides comprehensive business insights.

Migrating Existing Financial Data into a New ERP System

The migration of existing financial data into a new accounting ERP system is a critical and often complex undertaking that demands meticulous planning, execution, and validation to ensure data integrity and a smooth transition. This process involves extracting data from legacy systems, transforming it into a format compatible with the new ERP, and loading it accurately. The success of the ERP implementation hinges significantly on the quality and completeness of the migrated data, as it forms the foundation for all future financial reporting and analysis.The migration process typically begins with a comprehensive data assessment and cleansing phase.

This involves identifying all relevant financial data sources, which may include general ledger balances, accounts payable and receivable records, fixed asset registers, payroll data, and historical transaction data. A thorough audit of this data is performed to identify and rectify inconsistencies, duplicates, outdated information, and errors. This cleansing is paramount; migrating flawed data into a new system will perpetuate existing problems and undermine the benefits of the new ERP.

For example, if historical customer payment data is inaccurate, the new AR module might miscalculate credit limits or generate incorrect aging reports. Businesses often develop data quality rules and employ data profiling tools to systematically identify and address these issues.Following data cleansing, the data transformation phase begins. This involves mapping data fields from the legacy system(s) to the corresponding fields in the new ERP.

This mapping needs to be precise, ensuring that financial data is translated correctly. For instance, chart of accounts structures may differ between systems, requiring careful re-categorization. Data transformation tools or custom scripts are often used to convert data formats, units of measure, and currency conventions as needed. A critical aspect here is defining the scope of historical data to be migrated.

While current open transactions (like outstanding invoices or purchase orders) are essential, decisions must be made about how much historical financial statement data (e.g., P&L, Balance Sheet for the last 3-5 years) needs to be migrated for comparative analysis and audit trail purposes. Migrating excessive historical transactional data can be resource-intensive and may not always be necessary for operational use in the new system.The data loading phase involves importing the transformed data into the new ERP system.

This is often done in stages, starting with master data (like customer and vendor lists, item codes) and then moving to transactional data. A pilot load with a subset of data is highly recommended to test the loading process and identify any technical issues. Once the data is loaded, a rigorous validation process is essential. This involves comparing summary-level data in the new ERP against reports from the legacy system to ensure that totals reconcile.

For example, the total balance of accounts receivable in the new ERP must match the total outstanding amount from the old system. Detailed sample testing of individual transactions and balances is also conducted to confirm accuracy. User acceptance testing (UAT) by key finance personnel is crucial at this stage to confirm that the migrated data is usable and meets business requirements.

Establishing a clear rollback plan in case of critical migration failures is also a vital component of the overall strategy.

Framework for User Training and Adoption

Ensuring maximum benefit from an implemented accounting ERP solution hinges on effective user training and fostering strong adoption rates across the organization. Without adequate training and buy-in from users, even the most sophisticated ERP system can fall short of its potential, leading to underutilization, workarounds, and continued reliance on old, inefficient methods. A well-structured training and adoption framework is therefore not an afterthought, but a fundamental component of the ERP implementation strategy.The framework for user training should commence early in the implementation process, ideally during the system design and configuration phases.

This allows users to provide valuable input and become familiar with the system’s capabilities and their specific roles within it. Training should be role-based and tailored to the specific functions each user group will perform. For instance, accounts payable clerks will require in-depth training on invoice processing and payment runs, while sales representatives might focus on order entry and customer management modules.

A blended learning approach is often most effective, combining various methods such as instructor-led classroom sessions, online e-learning modules, hands-on exercises in a test environment, and quick reference guides. The training environment should closely mirror the production system, allowing users to practice real-world scenarios without impacting live data.Post-go-live support is a critical element of the adoption strategy. This includes providing readily accessible help desks, on-site support staff, and clear escalation paths for user queries and issues.

Establishing a network of “super-users” or “champions” within each department can be highly beneficial. These individuals, who receive advanced training, act as first-line support for their colleagues, answer common questions, and reinforce best practices. Their role is invaluable in fostering a culture of adoption and continuous learning. Regular refresher training sessions and advanced training on new features or modules should be scheduled to ensure that users remain proficient and can leverage the full capabilities of the ERP system as it evolves.To drive adoption, it’s essential to communicate the benefits of the ERP system clearly and consistently to all stakeholders.

Highlighting how the system will simplify tasks, improve accuracy, provide better insights, and ultimately contribute to the company’s success can foster a positive attitude. User feedback mechanisms should be established to continuously gather input on the system’s usability and identify areas for improvement. Celebrating early wins and successes achieved through the ERP implementation can also boost morale and encourage further adoption.

Furthermore, incorporating ERP usage into performance metrics where appropriate can incentivize users to engage with the system effectively. A dedicated change management plan, addressing potential resistance to change and outlining strategies for communication, stakeholder engagement, and reinforcement, is integral to the overall success of the training and adoption framework.

Enhancing Financial Visibility and Decision-Making with Advanced Accounting Enterprise Resource Planning Capabilities

In today’s fast-paced business environment, making informed decisions hinges on having a clear and accurate understanding of an organization’s financial health. Advanced accounting Enterprise Resource Planning (ERP) systems are no longer just tools for bookkeeping; they are sophisticated platforms that provide unparalleled financial visibility, transforming raw data into actionable intelligence. This enhanced insight empowers businesses to navigate complex market dynamics, identify opportunities, and mitigate risks with greater confidence.

The integration of various financial modules within an ERP system creates a unified view, breaking down departmental silos and offering a holistic perspective on financial performance, which is critical for strategic planning and operational efficiency.The core strength of modern accounting ERPs lies in their ability to provide real-time financial reporting. This means that instead of waiting for month-end or quarter-end reports, business leaders can access up-to-the-minute financial data.

This immediate access is invaluable for strategic planning. For instance, a company can track sales performance against targets daily, allowing for swift adjustments to marketing campaigns or sales strategies if they are underperforming. Similarly, real-time cash flow reporting enables proactive management of liquidity, preventing potential shortfalls and optimizing investment opportunities. When a business can see the immediate impact of its operational decisions on its financial standing, it can pivot much faster.

This agility is a significant competitive advantage. Imagine a retail business experiencing an unexpected surge in demand for a particular product. With real-time inventory and sales data integrated into their ERP, they can immediately assess the impact on their supply chain, production, and overall profitability, and make informed decisions about reordering, production scheduling, or even adjusting pricing to capitalize on the demand.

This level of responsiveness, driven by real-time data, is fundamental to strategic planning in a dynamic market. Furthermore, this constant stream of accurate financial information allows for more reliable forecasting. Businesses can build more robust financial models, test various scenarios, and understand the potential outcomes of different strategic initiatives before committing significant resources. This predictive capability, fueled by real-time reporting, is a cornerstone of effective strategic planning in the modern era.

Business Intelligence and Analytics for Deeper Insights

Business intelligence (BI) and analytics modules are integral components of advanced accounting ERP systems, designed to extract meaningful insights from the vast amounts of financial data they process. These modules go beyond basic reporting by employing sophisticated tools to analyze trends, identify patterns, and predict future outcomes. BI tools often present data through interactive dashboards, charts, and graphs, making complex financial information easily digestible for users at all levels of the organization.

This visual representation allows decision-makers to quickly grasp key performance indicators (KPIs) and identify areas that require attention. For example, a sales manager could use a BI dashboard to see which product lines are generating the highest profit margins, which sales regions are underperforming, and which customer segments are most valuable. This granular level of insight enables targeted strategies to boost sales, improve profitability, and optimize resource allocation.Analytics capabilities within an ERP system delve even deeper, often utilizing statistical modeling and machine learning to uncover hidden correlations and predict future financial events.

This can include forecasting revenue, predicting customer churn, identifying potential fraud, or optimizing pricing strategies. For instance, an analytics module might identify a subtle trend in customer purchasing behavior that, if acted upon, could lead to the development of a new, highly profitable product or service. By analyzing historical sales data, market trends, and economic indicators, the system can provide a more accurate sales forecast than traditional manual methods.

This predictive power is invaluable for inventory management, production planning, and financial budgeting. Furthermore, these modules facilitate ‘what-if’ scenario analysis, allowing businesses to model the financial impact of various strategic decisions, such as launching a new product, entering a new market, or acquiring another company. The ability to test these scenarios virtually before implementation significantly reduces risk and improves the likelihood of successful strategic execution.

The insights derived from BI and analytics are not just about understanding the past; they are about proactively shaping the future of the business.

Automated Workflows and Error Reduction in Financial Statements

The implementation of automated workflows within an accounting ERP system fundamentally transforms the accuracy and efficiency of financial statement generation. Manual processes are inherently prone to human error, whether it’s a simple data entry mistake, a miscalculation, or a forgotten step in a complex reconciliation. Automated workflows, on the other hand, standardize procedures and eliminate the need for repetitive manual tasks, thereby significantly reducing the likelihood of these errors.

For example, in the accounts payable process, an ERP system can automate the matching of purchase orders, receiving reports, and vendor invoices. This three-way match ensures that payments are only processed for goods or services that have been legitimately ordered and received, preventing overpayments and duplicate invoices.Consider the process of month-end closing. Traditionally, this involves numerous manual journal entries, reconciliations, and consolidations across different ledgers and departments.

An ERP system automates many of these steps. For instance, recurring journal entries can be set up to post automatically at predefined intervals. Bank reconciliations can be largely automated by directly importing bank statements and allowing the system to match transactions based on predefined rules. Intercompany transactions, often a complex and error-prone area, can be automatically generated and eliminated within the ERP, ensuring consistency across consolidated financial statements.

This automation not only speeds up the closing process but also dramatically improves the accuracy of the resulting financial statements. When financial statements are generated from a system where data integrity is maintained through automated checks and balances, stakeholders can have a higher degree of confidence in their reliability. This accuracy is paramount for investor relations, regulatory filings, and internal strategic decision-making.

The reduction in manual errors means less time spent on corrections and investigations, freeing up finance teams to focus on more strategic activities like financial analysis and business partnering.

Facilitating Regulatory Compliance and Audit Trails

A critical function of modern accounting ERP systems is their role in ensuring compliance with a multitude of regulatory requirements and providing robust audit trails. Regulatory landscapes are constantly evolving, with new laws and standards being introduced regularly. ERP systems are designed to be adaptable to these changes, often with built-in functionalities that help businesses adhere to standards like GAAP, IFRS, SOX, and various tax regulations.

For instance, an ERP can automatically calculate taxes based on jurisdictional rules and generate the necessary reports for tax filings. It can also enforce segregation of duties, a key internal control mandated by regulations like Sarbanes-Oxley (SOX), by restricting user access to specific modules or functions based on their roles.The audit trail functionality within an ERP is indispensable for both internal and external audits.

Every transaction, modification, and access event within the system is logged, creating a comprehensive and immutable record of all financial activities. This log details who performed an action, when it was performed, and what changes were made. For example, if a journal entry is created, modified, or deleted, the audit trail will record the original entry, the subsequent changes, and the user responsible for each action.

This transparency is invaluable during an audit, as it allows auditors to quickly trace transactions back to their source and verify their accuracy and authorization. It also serves as a powerful deterrent against fraud and errors, as employees know their actions are being recorded. Furthermore, ERP systems can streamline the audit process by providing auditors with direct access to relevant data and reports, often in a standardized format.

This reduces the time and effort required for auditors to gather information, leading to more efficient and cost-effective audits. The ability to generate comprehensive audit trails also aids in dispute resolution and provides a historical record for retrospective analysis, further bolstering the organization’s governance and accountability framework.

Exploring the future trajectory and evolving landscape of accounting Enterprise Resource Planning technologies.: Accounting Erp

As the business world continues its rapid digital transformation, accounting ERP systems are not standing still. They are evolving at an unprecedented pace, driven by technological advancements and the ever-increasing demands of global commerce. This evolution promises to make financial management more intelligent, integrated, and accessible than ever before. We’re moving beyond basic bookkeeping and into an era of predictive analytics, seamless omnichannel operations, and intuitive user experiences that redefine how businesses manage their finances.

Impact of Artificial Intelligence and Machine Learning on Accounting ERP Capabilities

Artificial intelligence (AI) and machine learning (ML) are no longer futuristic concepts; they are actively reshaping the capabilities of modern accounting ERP systems. These technologies are infusing intelligence into processes that were once manual and time-consuming, leading to significant improvements in efficiency, accuracy, and strategic insight. AI-powered algorithms can analyze vast datasets with incredible speed, identifying patterns, anomalies, and trends that would be virtually impossible for human accountants to detect.

This translates into more robust fraud detection, where ML models can flag suspicious transactions based on historical data and deviations from normal behavior. Furthermore, AI is revolutionizing forecasting and budgeting. Instead of relying solely on historical data, predictive analytics can incorporate external factors like market trends, economic indicators, and even social media sentiment to generate more accurate financial projections. This allows businesses to be more proactive in their financial planning, anticipating future needs and potential challenges.Automated data entry and reconciliation, powered by AI and Natural Language Processing (NLP), are significantly reducing the burden of tedious tasks.

For instance, AI can now extract relevant information from invoices, receipts, and bank statements with remarkable accuracy, automating the process of journal entry creation and significantly minimizing human error. Machine learning algorithms can also learn from user behavior and transaction patterns to suggest optimal chart of accounts classifications or identify recurring discrepancies, further streamlining the closing process. The concept of “intelligent automation” is becoming central to accounting ERPs, where AI not only performs tasks but also learns and adapts to improve its performance over time.

This continuous learning loop ensures that the system becomes more effective and efficient as it is used, providing ongoing value to the organization. The implications for auditing are also profound. AI can sift through entire transaction histories, identifying high-risk areas and potential compliance issues, allowing auditors to focus their efforts on more complex and strategic matters. This shift from reactive to proactive financial management, driven by AI and ML, is empowering businesses to make faster, more informed decisions, ultimately contributing to greater profitability and competitive advantage.

Growing Importance of Integration with E-commerce Platforms and Supply Chain Management

In today’s interconnected business environment, the traditional siloed approach to financial management is no longer sufficient. The growing importance of integration with e-commerce platforms and supply chain management (SCM) systems is paramount for achieving comprehensive financial oversight and operational efficiency. As businesses increasingly operate across multiple sales channels, including online marketplaces, direct-to-consumer websites, and brick-and-mortar stores, a unified view of revenue and costs becomes critical.

Integrating accounting ERPs with e-commerce platforms allows for real-time synchronization of sales data, inventory levels, and customer information. This means that as soon as a sale is made online, the accounting system can automatically record the revenue, update inventory, and trigger relevant financial reporting. This eliminates the need for manual data entry, reducing errors and providing an immediate, accurate picture of sales performance.

Furthermore, it enables better management of online payment gateways, sales tax calculations, and returns processing, all of which are essential for financial accuracy.Similarly, the integration of accounting ERP with SCM systems provides a holistic view of the entire value chain, from procurement to delivery. This integration allows for the seamless flow of information regarding raw material costs, production expenses, warehousing, logistics, and finished goods inventory.

By connecting these systems, businesses can gain deep insights into their cost of goods sold (COGS), optimize inventory levels to minimize holding costs and prevent stockouts, and improve the accuracy of financial forecasts. For example, when a supplier invoice is received and matched against a purchase order and goods receipt within the SCM system, the accounting ERP can automatically process the payment and update the financial records.

This end-to-end visibility allows for better negotiation with suppliers, identification of inefficiencies in the supply chain, and more accurate product costing. It also facilitates improved cash flow management, as businesses can better predict their outgoing payments and incoming receipts based on the movement of goods and services. Ultimately, this deep integration fosters a more agile and responsive business operation, enabling companies to adapt quickly to market changes and maintain a competitive edge by understanding and controlling their financial position across all operational touchpoints.

Vision for Mobile Accessibility and User Experience in ERP Interfaces

The future of accounting ERP interfaces is undeniably mobile-first and user-centric. As the workforce becomes increasingly mobile and distributed, the demand for accessible, intuitive, and engaging ERP solutions is soaring. The vision is to move away from complex, desktop-bound interfaces towards sleek, responsive applications that can be accessed anytime, anywhere, on any device. This means that accountants and finance professionals will be able to perform critical tasks, such as approving expenses, reviewing financial reports, or managing invoices, directly from their smartphones or tablets, whether they are at a client site, traveling, or working remotely.

The user experience (UX) will be paramount, focusing on simplicity, clarity, and ease of navigation. Think of modern consumer applications – uncluttered interfaces, personalized dashboards, and guided workflows that minimize the learning curve. This will involve leveraging advanced design principles, intuitive visual cues, and personalized user profiles that present the most relevant information and functionalities to each user.AI-powered chatbots and virtual assistants will play a significant role in enhancing this mobile UX.

Users will be able to ask natural language questions like “What is our current cash balance?” or “Show me the outstanding invoices for client X,” and receive immediate, accurate answers. These assistants will also guide users through complex processes, offering contextual help and suggestions, thereby democratizing access to financial data and insights. The focus will shift from merely presenting data to enabling action.

Mobile ERPs will offer functionalities like on-the-go expense capture with automatic receipt scanning and categorization, digital signature capabilities for approvals, and real-time alerts for critical financial events. Gamification elements might also be incorporated to encourage user engagement and data accuracy, turning routine tasks into more interactive experiences. Furthermore, the mobile interface will be designed to be highly personalized, allowing users to customize their dashboards, set up their preferred reporting views, and receive tailored notifications.

This evolution will not only boost productivity and efficiency but also foster a more collaborative and data-driven culture within organizations, empowering every employee to contribute to sound financial management.

Potential Challenges and Opportunities in Emerging Technologies for Financial Management Software

The rapid influx of emerging technologies into the financial management software landscape presents a dual-edged sword: a wealth of opportunities for innovation and improvement, alongside significant challenges that businesses must navigate. One of the most prominent opportunities lies in the continued advancement of AI and machine learning, which promise to automate more complex decision-making processes, enhance predictive analytics, and identify intricate patterns in financial data that were previously undetectable.

This can lead to unprecedented levels of efficiency, accuracy, and strategic foresight. For instance, AI can be trained to predict potential cash flow shortages weeks in advance, allowing businesses to take proactive measures. Blockchain technology offers another significant opportunity, particularly in areas like secure transaction recording, improved audit trails, and enhanced supply chain transparency. Its decentralized nature can revolutionize how financial data is shared and verified, potentially reducing fraud and streamlining reconciliation processes across multiple entities.

The opportunity for real-time, immutable financial records is immense.However, these opportunities are accompanied by considerable challenges. A primary concern is the security and privacy of data. As financial management software becomes more interconnected and relies on cloud-based solutions, the risk of cyber threats and data breaches escalates. Implementing robust security protocols, encryption, and access controls becomes paramount. Another significant challenge is the complexity of implementation and integration.

Newer technologies often require specialized expertise, substantial investment in infrastructure, and careful planning to integrate seamlessly with existing systems. Businesses may struggle with the cost and technical know-how needed to adopt these advancements effectively. The talent gap is also a critical challenge; there’s a growing need for finance professionals who possess not only traditional accounting skills but also a strong understanding of data analytics, AI, and emerging technologies.

Furthermore, regulatory compliance in the face of rapidly evolving technology can be a moving target. Staying abreast of new regulations and ensuring that financial software adheres to them requires constant vigilance. The ethical implications of AI in financial decision-making, such as algorithmic bias, also present a complex area that requires careful consideration and governance. Despite these challenges, the opportunity to achieve a more intelligent, efficient, and secure financial management ecosystem through embracing these emerging technologies is substantial, driving businesses towards a more agile and data-driven future.

Last Point

In conclusion, the adoption and strategic implementation of an accounting ERP system represent a pivotal step for any business aiming for robust financial health and sustainable growth. By centralizing data, automating processes, and providing real-time insights, these systems empower organizations to make informed decisions, enhance operational efficiency, and maintain a competitive edge in an ever-evolving market. The journey from selection to optimization is an investment that yields significant returns, paving the way for greater financial control, improved compliance, and a clearer vision for the future.

FAQ Explained

What is the primary benefit of using an accounting ERP system over separate accounting software?

The primary benefit is integration. An accounting ERP connects all financial functions and often other business processes, providing a single source of truth and eliminating data silos, which leads to greater accuracy and efficiency compared to standalone accounting software.

How does an accounting ERP system handle different currencies for international businesses?

Most accounting ERP systems are designed with multi-currency capabilities. They can manage transactions in various currencies, perform automatic exchange rate conversions, and generate consolidated financial reports that account for currency fluctuations.

Can an accounting ERP system help with budgeting and forecasting?

Yes, advanced accounting ERP systems often include robust budgeting and forecasting modules. These tools allow businesses to create detailed budgets, track actual spending against them, and generate forecasts based on historical data and projected trends.

What is the typical implementation timeline for an accounting ERP system?

Implementation timelines vary significantly based on the size and complexity of the business, the chosen ERP system, and the level of customization required. However, a typical implementation can range from a few months to over a year.