Accounting and business management software represents a pivotal shift in how modern commerce operates. This comprehensive approach moves beyond siloed functionalities, offering a unified platform designed to streamline operations and enhance decision-making.

This exploration delves into the core of what makes these integrated systems indispensable, examining their fundamental purpose, the diverse options available, the transformative power of automation, the impact of advanced analytics, the necessity of seamless integration, and the best practices for successful adoption. By understanding these facets, businesses can unlock new levels of efficiency and strategic insight.

Unpacking the Fundamental Purpose of Integrated Accounting and Business Management Software in Modern Commerce

In today’s dynamic commercial landscape, businesses of all sizes are increasingly reliant on sophisticated tools to navigate the complexities of financial operations and day-to-day management. Integrated accounting and business management software has emerged as a cornerstone solution, moving beyond simple bookkeeping to offer a holistic approach to organizational control and strategic decision-making. The fundamental purpose of such systems is to unify disparate data streams, streamline processes, and provide real-time visibility into a company’s financial health and operational performance.

This integration eliminates the inefficiencies and potential for errors inherent in manual data entry or the use of siloed applications, thereby fostering greater accuracy, agility, and a competitive edge. By centralizing critical business functions, these software solutions empower businesses to operate more efficiently, make informed decisions, and adapt quickly to market changes. The core functionalities that distinguish comprehensive integrated accounting and business management software from standalone tools lie in their ability to create a single source of truth for all business data.

Standalone accounting software, for instance, might excel at managing ledgers and generating financial reports, but it often lacks the capacity to seamlessly connect with inventory tracking, customer relationship management (CRM), or project management modules. This disconnect forces businesses to manually reconcile data between different systems, a process that is not only time-consuming but also prone to errors. Integrated solutions, on the other hand, are designed with interconnected modules that share information dynamically.

For example, when a sale is recorded in the sales order module, the inventory levels are automatically updated, the accounts receivable is generated, and the general ledger is affected in real-time. This eliminates the need for redundant data entry and ensures that all departments are working with the most current and accurate information. Furthermore, integrated systems often offer advanced features such as automated workflows, robust reporting and analytics, budgeting and forecasting tools, and compliance management, which are typically absent or limited in standalone applications.

This comprehensive suite of functionalities allows businesses to move from reactive problem-solving to proactive strategic planning, optimizing resource allocation and identifying growth opportunities with greater precision.

Essential Modules within Integrated Systems

A robust integrated accounting and business management software solution typically comprises several interconnected modules, each designed to manage a specific facet of business operations while contributing to the overall unified data ecosystem. These modules work in concert, ensuring that information flows seamlessly between different functional areas, providing a comprehensive view of the business.

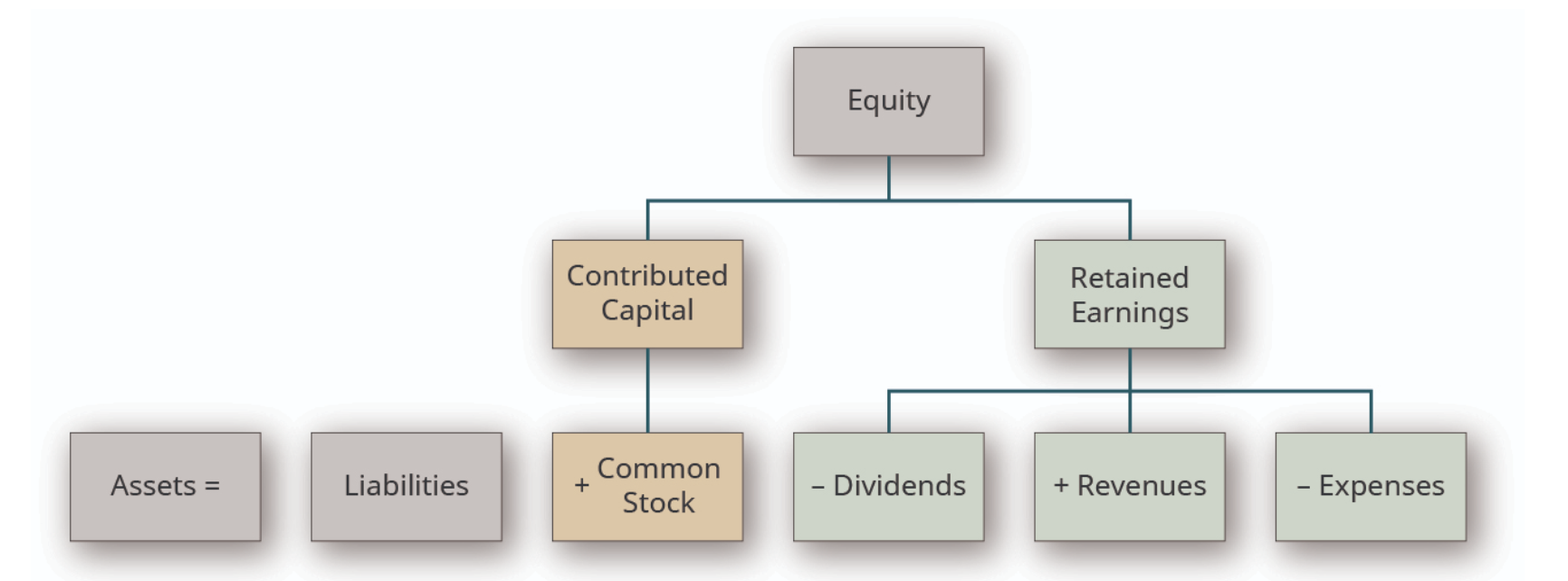

- General Ledger (GL): This is the heart of any accounting system. The GL records all financial transactions, categorizing them into accounts (e.g., assets, liabilities, equity, revenue, expenses). In an integrated system, the GL automatically receives updates from all other modules, such as accounts payable, accounts receivable, and payroll, ensuring that financial statements accurately reflect the company’s overall financial position.

- Accounts Payable (AP): This module manages all outgoing payments to suppliers and vendors. It tracks invoices, handles approvals, schedules payments, and manages vendor relationships. When an invoice is entered into AP, it is linked to the corresponding purchase order and, upon approval, can trigger a payment process that simultaneously updates the GL and potentially impacts inventory if the purchase is for stock.

- Accounts Receivable (AR): Conversely, AR manages all incoming payments from customers. It tracks sales invoices, monitors payment due dates, facilitates collections, and manages customer credit. When a sale is made and invoiced, the AR module records the transaction, and upon receipt of payment, it updates both the AR records and the GL, reflecting the increase in cash and reduction in outstanding receivables.

- Inventory Management: This module is crucial for businesses dealing with physical goods. It tracks stock levels, manages stock movements (receipts, issues, transfers), calculates cost of goods sold (COGS), and can even handle multiple warehouses or locations. When inventory is sold, the inventory module automatically reduces stock levels and provides data to the AR and GL modules to reflect the sale and its associated costs.

When new stock is received, it updates inventory levels and affects AP and the GL for the purchase.

- Project Costing: For businesses that undertake projects, this module allows for the tracking of costs associated with specific projects, including labor, materials, and overhead. It enables businesses to monitor project profitability, allocate expenses accurately, and provide clients with detailed billing. Costs incurred for a project, whether from direct labor, material purchases, or other expenses, are captured and linked to the specific project, influencing both operational tracking and financial reporting through the GL.

Tangible Benefits of a Unified Data Approach

Adopting a unified approach to financial and operational data management through integrated software solutions yields a multitude of tangible benefits that can significantly impact a business’s efficiency, profitability, and long-term sustainability. The elimination of data silos and manual reconciliation processes alone leads to substantial time savings and a dramatic reduction in the potential for human error. This increased accuracy translates directly into more reliable financial reporting, enabling management to make decisions based on trustworthy data rather than guesswork. One of the most significant benefits is enhanced operational efficiency.

When inventory levels are automatically updated upon sale or receipt, or when a purchase order automatically generates an accounts payable entry, the manual effort required for these tasks is drastically reduced. This frees up employees to focus on more strategic activities rather than administrative drudgery. Furthermore, integrated systems often facilitate automated workflows for approvals, notifications, and task assignments, further streamlining processes and ensuring that critical business operations proceed without unnecessary delays. Improved financial visibility and control are also paramount.

With all financial and operational data residing in a single system, businesses gain a real-time, comprehensive view of their performance. This allows for more accurate budgeting and forecasting, as historical data from all relevant modules can be easily accessed and analyzed. Businesses can identify trends, anticipate cash flow issues, and proactively manage their finances. For instance, by monitoring accounts receivable aging reports alongside inventory turnover rates, a company can better manage its working capital and identify potential issues before they escalate. Moreover, integrated solutions empower better decision-making.

Access to up-to-the-minute, accurate data across all business functions allows managers to identify profitable product lines, understand customer purchasing patterns, evaluate project profitability, and pinpoint areas of inefficiency. This data-driven approach fosters agility, enabling businesses to respond more effectively to market changes and seize new opportunities. The ability to generate consolidated reports that combine financial data with operational metrics provides a holistic perspective that is invaluable for strategic planning and competitive analysis.

Conceptual Diagram of Interconnected Software Components

To visualize the interconnectedness of integrated accounting and business management software components and their impact on overall business visibility, imagine a central hub representing the core database. This hub is the repository for all transactional data, ensuring consistency and real-time updates across the entire system. Radiating from this central hub are the various functional modules, each feeding into and drawing from this shared data pool. At the core, the General Ledger acts as the financial backbone.

It receives summarized or detailed transaction data from all other modules. For example, every sale recorded in the Accounts Receivable module will eventually impact the revenue and cash accounts in the GL. Similarly, every payment made through the Accounts Payable module will affect expense and cash accounts in the GL. The Sales and Order Management module, often linked to Accounts Receivable and Inventory Management, is where customer orders are initiated.

When an order is placed, it can trigger an update in inventory levels, create a record in AR for invoicing, and ultimately feed the revenue and cost of goods sold into the GL upon fulfillment. The Procurement and Accounts Payable module handles the acquisition of goods and services. A purchase order created here can directly update expected inventory receipts and, upon invoice processing, generate an AP entry and impact the relevant expense or asset accounts in the GL.

If the purchase is for inventory, it also directly affects the Inventory Management module. The Inventory Management module is intricately linked to both sales and procurement. It tracks stock levels, costs, and movements. When inventory is sold, it reduces stock and provides data for COGS in the GL. When new inventory is received, it increases stock and is linked to AP and the GL for the purchase cost. For businesses with project-based work, the Project Management and Costing module acts as a specialized feeder.

It tracks direct costs (labor, materials) and overhead allocated to specific projects. These costs are then posted to the GL, allowing for accurate project profitability analysis and financial reporting. Finally, the Reporting and Analytics layer sits atop all these modules. It can query the central database to generate a wide array of reports, from standard financial statements (balance sheet, income statement, cash flow) to customized operational reports that combine financial and non-financial data.

For instance, a report could show the profitability of specific products by linking sales data from AR with COGS data from Inventory and operational expenses from the GL. This layered architecture ensures that data flows efficiently, updates are instantaneous, and a comprehensive, real-time view of the business is available to all stakeholders, facilitating informed decision-making and strategic agility.

Navigating the Diverse Landscape of Accounting and Business Management Software Options Available to Enterprises of Varying Sizes

The world of accounting and business management software is vast and varied, offering solutions tailored to the unique needs and operational scales of businesses today. From solopreneurs just starting out to multinational corporations with complex global operations, there’s a software ecosystem designed to streamline processes, enhance financial visibility, and drive growth. Understanding these diverse offerings and how they align with specific business requirements is crucial for making informed technology investments.Choosing the right software isn’t a one-size-fits-all proposition.

It requires a careful evaluation of current infrastructure, future growth aspirations, security protocols, and budget constraints. The market presents a spectrum of options, each with its own set of advantages and disadvantages. This exploration delves into the critical distinctions between deployment models, the specific features catering to different business sizes, and the essential criteria for evaluating software vendors to ensure a successful and sustainable partnership.

Cloud-Based Versus On-Premise Deployment Models

The fundamental choice in deploying accounting and business management software often boils down to cloud-based versus on-premise solutions. Each model presents a distinct approach to infrastructure, maintenance, and accessibility, making one more suitable than the other depending on a business’s specific needs, existing IT setup, and security posture.Cloud-based software, often delivered as Software-as-a-Service (SaaS), is hosted on the vendor’s servers and accessed via the internet.

This model offers significant advantages in terms of initial cost, scalability, and ease of implementation. For businesses with limited IT resources or those prioritizing rapid deployment, the cloud is often the preferred choice. Updates and maintenance are handled by the vendor, reducing the burden on internal IT teams. Furthermore, cloud solutions typically offer robust accessibility, allowing users to access financial data from anywhere with an internet connection, which is invaluable for remote teams or businesses with multiple locations.

However, concerns about data security and control can arise, though reputable cloud providers invest heavily in security measures and compliance certifications. Businesses with highly sensitive data or strict regulatory requirements might find themselves scrutinizing the data residency and encryption protocols offered by cloud vendors. The subscription-based pricing model also means ongoing operational expenses, which, over the long term, could potentially exceed the upfront investment of an on-premise solution.On-premise software, conversely, is installed and run on a company’s own servers and IT infrastructure.

This model provides businesses with complete control over their data and systems, which can be a significant advantage for organizations with stringent security policies or unique integration needs. The upfront investment in hardware, software licenses, and implementation can be substantial, but it often leads to lower long-term operational costs, as there are no recurring subscription fees. Businesses opting for on-premise solutions typically have dedicated IT staff capable of managing, maintaining, and securing the software and infrastructure.

This model is particularly appealing to larger enterprises or those in highly regulated industries where data sovereignty and absolute control are paramount. However, on-premise solutions require significant internal expertise for updates, patches, and troubleshooting, and scalability can be more challenging and costly, often involving additional hardware purchases and lengthy implementation cycles. The accessibility is also generally limited to within the company’s network unless specific remote access solutions are implemented, which can add complexity and security risks.

Key Features for Small and Medium-Sized Businesses

Small and medium-sized businesses (SMBs) often operate with leaner budgets and fewer dedicated IT personnel, making ease of use and affordability paramount when selecting accounting and business management software. The ideal solutions for this segment focus on core functionalities, intuitive interfaces, and cost-effective deployment models.A primary feature for SMBs is an intuitive and user-friendly interface. This means clear navigation, straightforward data entry, and easily understandable reports.

Software that requires extensive training or a steep learning curve can be a significant impediment to adoption and productivity. Many SMB-focused platforms offer guided setup processes and readily available help resources to facilitate quick integration into daily operations. Another crucial aspect is the ability to manage essential accounting functions without unnecessary complexity. This includes features like streamlined invoicing and billing, simplified expense tracking, bank reconciliation, and basic financial reporting (e.g., profit and loss statements, balance sheets).

The software should also be capable of handling core business management tasks such as inventory tracking, customer relationship management (CRM) at a foundational level, and project management if applicable to the business model.Affordability is a non-negotiable factor for most SMBs. This often translates to subscription-based pricing models with tiered plans that allow businesses to pay only for the features they need, scaling up as they grow.

Free or low-cost introductory tiers are also attractive. Integration capabilities are also important, even for smaller businesses. The ability to connect with other essential tools like e-commerce platforms, payment gateways, or payroll services can significantly enhance efficiency and avoid manual data duplication. Cloud-based solutions are particularly well-suited for SMBs due to their typically lower upfront costs, predictable subscription fees, and reduced reliance on internal IT infrastructure.

Examples of such software often include QuickBooks Online, Xero, Zoho Books, and FreshBooks, which are designed with the SMB user in mind, offering a balance of essential features, ease of use, and competitive pricing. These platforms understand that SMBs need to focus on their core business, not on wrestling with complex software.

Advanced Capabilities for Larger Corporations

Large corporations operate with a complexity that necessitates robust, scalable, and highly integrated software solutions. Their financial operations often span multiple geographies, currencies, and business units, requiring advanced functionalities that go far beyond basic accounting.One of the most critical advanced capabilities for large enterprises is multi-currency support. This allows businesses to conduct transactions, manage accounts, and generate financial reports in various currencies, automatically handling exchange rate fluctuations and revaluations.

This is indispensable for companies with international sales, global subsidiaries, or extensive import/export activities. Sophisticated tax management is also essential, enabling compliance with diverse international tax regulations and automated tax calculations. Advanced reporting and analytics are another cornerstone. Larger corporations need the ability to generate highly customized reports, perform in-depth financial analysis, and create predictive models. This often involves multidimensional reporting capabilities that allow for slicing and dicing data by various parameters such as department, region, product line, or project.

Business intelligence (BI) tools integrated within the software or connected via APIs are crucial for deriving actionable insights from vast amounts of financial data.Integration with Enterprise Resource Planning (ERP) systems is paramount for large organizations. ERP systems provide a holistic view of a company’s operations, integrating finance with other critical functions like supply chain management, human resources, manufacturing, and customer service.

Accounting and business management software for large corporations must seamlessly integrate with these ERP platforms to ensure data consistency and operational efficiency across the entire enterprise. This integration often involves complex APIs and data synchronization protocols. Other advanced features include robust budgeting and forecasting tools, advanced workflow automation for approvals and processes, comprehensive audit trails for compliance, and sophisticated risk management modules.

Solutions like SAP S/4HANA, Oracle NetSuite, and Microsoft Dynamics 365 are examples of platforms designed to meet these extensive requirements, offering modularity and deep customization to adapt to the intricate needs of global enterprises.

Framework for Evaluating Software Vendors

When selecting an accounting and business management software vendor, a structured evaluation process is essential to ensure the chosen partner can meet current needs and support future growth. This framework Artikels key criteria to assess customer support, scalability, and long-term viability.Customer support is a critical factor, especially for businesses that may not have extensive in-house IT expertise. Evaluating the vendor’s support offerings should include assessing the availability and responsiveness of their support channels (e.g., phone, email, chat), the expertise of their support staff, and the availability of self-service resources like knowledge bases, tutorials, and community forums.

The quality and accessibility of training materials are also important, as effective onboarding and ongoing user education contribute significantly to software adoption and utilization. Understanding the vendor’s service level agreements (SLAs) for support response times and issue resolution is also crucial.Scalability refers to the software’s ability to grow with the business. This includes its capacity to handle increasing transaction volumes, user numbers, and data complexity without performance degradation.

For cloud-based solutions, scalability often means the ease with which additional users or modules can be added. For on-premise solutions, it might involve the ability to upgrade hardware or expand server capacity. A vendor’s product roadmap and commitment to innovation are also indicative of their understanding of evolving business needs and technological advancements.Long-term viability assesses the vendor’s financial stability, market reputation, and commitment to ongoing product development and security.

A vendor that is financially sound and has a strong track record is less likely to discontinue support or cease operations, ensuring a stable partnership. Researching customer reviews, case studies, and industry analyst reports can provide insights into the vendor’s reliability and customer satisfaction. It’s also important to understand the vendor’s pricing structure, including any potential hidden costs or future price increases, and to ensure that the total cost of ownership aligns with the business’s budget over the long term.

A vendor that demonstrates a clear vision for their product and a dedication to customer success is more likely to be a valuable long-term partner.

The profound impact of intelligent automation within accounting and business management software on operational efficiency.

In today’s fast-paced commercial environment, the integration of intelligent automation into accounting and business management software is no longer a luxury but a necessity for driving operational efficiency. This technology is fundamentally reshaping how businesses manage their financial operations, moving from labor-intensive manual processes to sophisticated, automated systems that minimize errors, accelerate workflows, and free up valuable human capital for more strategic endeavors.

The shift signifies a paradigm change, enabling businesses to achieve higher levels of productivity and accuracy, ultimately contributing to a stronger financial footing and enhanced competitiveness.The essence of intelligent automation in this domain lies in its ability to perform repetitive, rule-based tasks with unparalleled speed and precision. This not only reduces the burden on accounting staff but also significantly lowers the risk of human error, which can have costly implications.

By automating mundane processes, businesses can unlock substantial gains in efficiency, allowing for more timely financial reporting, better resource allocation, and a more agile response to market dynamics. The underlying intelligence within these systems means they can learn and adapt, further refining their performance over time and delivering continuous improvements in operational output.

Streamlining Routine Tasks and Reducing Manual Errors

The core of intelligent automation’s impact on operational efficiency is its capacity to automate and streamline the most routine and time-consuming accounting tasks. This not only accelerates processes but also dramatically reduces the likelihood of human error, which can lead to significant financial discrepancies and compliance issues. By offloading these repetitive duties, businesses can ensure greater accuracy and consistency in their financial records.Features such as automated invoicing are a prime example.

Instead of manually creating and sending out invoices, the software can generate them based on sales orders or service agreements, automatically populate customer details, item descriptions, quantities, and pricing, and then dispatch them via email or through a customer portal. This eliminates the need for data entry, reduces the chance of typos in amounts or client information, and ensures that invoices are sent out promptly, improving cash flow.

Similarly, automated expense tracking simplifies the process of managing employee reimbursements. Staff can submit receipts via a mobile app, and the software can automatically extract relevant data, categorize expenses, and route them for approval, significantly cutting down on manual data input and verification. Bank reconciliation, historically a painstaking manual task involving matching transactions from bank statements with internal accounting records, is now largely automated.

The software can automatically import bank feeds, identify matching transactions based on predefined rules, and flag discrepancies for review, saving hours of work and improving the accuracy of financial statements. These automated processes collectively contribute to a more efficient, accurate, and less error-prone financial operation.

Practical Application of Artificial Intelligence and Machine Learning

Beyond the automation of straightforward tasks, artificial intelligence (AI) and machine learning (ML) are injecting a new level of intelligence into accounting and business management software, enabling proactive risk management and insightful forecasting. These advanced technologies are moving beyond simply executing tasks to providing predictive capabilities and identifying anomalies that might escape human observation.AI and ML are revolutionizing fraud detection by analyzing vast datasets of transactions to identify patterns indicative of fraudulent activity.

Algorithms can be trained to recognize unusual transaction amounts, frequencies, or locations, flagging them for immediate investigation. This proactive approach helps businesses prevent financial losses before they occur. For instance, an ML model could identify a series of small, recurring transactions to an unknown vendor that suddenly spikes in volume, signaling a potential unauthorized activity. Predictive analytics for cash flow is another significant application.

By analyzing historical financial data, sales trends, and economic indicators, AI can forecast future cash inflows and outflows with greater accuracy. This allows businesses to anticipate potential cash shortages or surpluses, enabling better financial planning, investment decisions, and debt management. Companies can use these predictions to optimize working capital and avoid costly borrowing. Furthermore, automated compliance checks are becoming increasingly sophisticated.

AI can scan financial records and transactions against regulatory requirements, identifying potential non-compliance issues in real-time. This is invaluable for navigating complex tax laws and industry-specific regulations, reducing the risk of penalties and legal entanglements. For example, an AI system could flag transactions that don’t adhere to specific accounting standards or identify potential issues with VAT or sales tax calculations, ensuring businesses remain compliant.

Implementing Automated Workflows within a Business Context

The successful integration of automated workflows within accounting and business management software requires a structured, step-by-step approach to ensure seamless adoption and maximize benefits. This process involves careful planning, configuration, testing, and ongoing refinement.The implementation journey typically begins with an assessment of current processes and identification of areas ripe for automation. This involves mapping out existing workflows, identifying bottlenecks, and prioritizing tasks that are repetitive, rule-based, and prone to error.

The next crucial step is selecting the right software solution that aligns with the business’s specific needs and offers robust automation capabilities. Following software selection, the system needs to be configured to reflect the company’s unique chart of accounts, tax settings, customer and vendor data, and approval hierarchies. This often involves importing existing data and setting up specific rules and triggers for automated actions, such as invoice approval limits or payment terms.

A critical phase is the testing and validation of these automated workflows. This involves running pilot tests with sample data and then gradually moving to live transactions to ensure accuracy, efficiency, and adherence to business policies. User training is paramount during this stage; staff must be adequately trained on how to use the new automated features, understand their roles in the automated processes, and know how to handle exceptions or exceptions that the system cannot resolve.

Once the system is live, continuous monitoring and optimization are essential. This involves regularly reviewing the performance of automated workflows, analyzing system logs for errors or inefficiencies, and gathering feedback from users. Based on this analysis, adjustments can be made to the rules, triggers, or configurations to further enhance efficiency and accuracy. For example, if an automated expense approval process is consistently flagging legitimate expenses as exceptions, the AI rules might need to be refined to better recognize these patterns.

Empowering Staff for Strategic Financial Planning and Decision-Making

The profound impact of intelligent automation extends beyond mere efficiency gains; it fundamentally empowers accounting and finance staff by liberating them from tedious, transactional tasks and enabling them to engage in more strategic, value-added activities. This shift is crucial for the evolution of the finance function within any modern organization.When routine processes like data entry, invoice processing, bank reconciliation, and report generation are automated, finance professionals are no longer bogged down by the minutiae of day-to-day operations.

This frees up significant amounts of time and cognitive energy. Instead of spending hours reconciling accounts, they can dedicate that time to analyzing financial trends, developing more sophisticated financial models, and identifying opportunities for cost savings or revenue enhancement. The insights generated by AI and ML within the software, such as predictive cash flow forecasts or anomaly detection for fraud, provide a richer foundation for strategic discussions.

Staff can move from simply reporting historical data to proactively advising on future financial performance and risk mitigation. This elevates their role from that of bookkeepers to strategic partners within the business. Furthermore, the increased accuracy and real-time visibility provided by automated systems mean that decision-makers have access to more reliable and up-to-date financial information. This allows for more informed and timely strategic planning, whether it involves investment decisions, budgeting, resource allocation, or expansion strategies.

The ability to conduct more in-depth scenario planning and financial modeling becomes feasible when the foundational data is clean, readily available, and accurately processed through automation. Ultimately, intelligent automation transforms the finance department into a more agile, insightful, and strategically influential part of the organization.

Elevating Business Decision-Making Through Advanced Reporting and Analytical Capabilities of Integrated Software

Integrated accounting and business management software goes far beyond mere transaction recording. It transforms raw financial data into actionable intelligence, empowering businesses to make more informed and strategic decisions. By providing robust reporting and sophisticated analytical tools, these platforms offer a panoramic view of an organization’s financial health, operational performance, and market positioning. This shift from reactive bookkeeping to proactive strategic planning is crucial for navigating the complexities of modern commerce and achieving sustainable growth.

The ability to access and interpret data quickly and accurately allows businesses to identify trends, anticipate challenges, and capitalize on emerging opportunities, ultimately driving profitability and competitive advantage.

Financial Report Generation and Their Significance

The core of any robust accounting system lies in its ability to generate essential financial reports. These documents are not just regulatory requirements; they are vital diagnostic tools that provide a snapshot of a company’s financial standing at a specific point in time or over a defined period. Understanding these reports is fundamental for stakeholders, from internal management to external investors and creditors.

- Profit and Loss (P&L) Statement: Also known as the Income Statement, this report details a company’s revenues, expenses, and profits or losses over a specific accounting period (e.g., a quarter or a year). It answers the fundamental question: “Is the business making money?” A well-structured P&L statement allows for the analysis of revenue streams, the identification of major cost drivers, and the assessment of operational efficiency.

Trends in gross profit margins, operating expenses, and net income can reveal areas of strength and weakness. For instance, a declining gross profit margin might indicate rising cost of goods sold or pricing pressures, while an increase in operating expenses without a corresponding rise in revenue could signal inefficiencies.

- Balance Sheet: This report presents a company’s assets, liabilities, and equity at a specific point in time, adhering to the fundamental accounting equation: Assets = Liabilities + Equity. It provides a clear picture of what a company owns, what it owes, and the net worth of the owners. The balance sheet is crucial for assessing a company’s liquidity, solvency, and financial structure.

Key ratios derived from the balance sheet, such as the current ratio (current assets / current liabilities) and debt-to-equity ratio (total liabilities / total equity), offer insights into a company’s ability to meet its short-term and long-term obligations. A healthy balance sheet indicates financial stability and a strong foundation for future growth.

- Cash Flow Statement: This statement tracks the movement of cash into and out of a business over a specific period. It is divided into three main activities: operating, investing, and financing. Unlike the P&L, which can include non-cash items, the cash flow statement focuses purely on actual cash transactions. This is critical because a profitable company can still face bankruptcy if it runs out of cash.

The cash flow statement helps assess a company’s ability to generate cash from its operations, fund its investments, and meet its debt obligations. Positive cash flow from operations is a strong indicator of a healthy and sustainable business.

These reports, when generated consistently and accurately by integrated software, provide the foundational data for all subsequent strategic analysis and decision-making.

Customizable Dashboards and Real-Time Data Visualization for Immediate Insights

The advent of integrated accounting and business management software has revolutionized how businesses access and interpret critical information, largely through the power of customizable dashboards and real-time data visualization tools. These features move beyond static reports, offering dynamic, at-a-glance views of Key Performance Indicators (KPIs), allowing decision-makers to grasp the pulse of the business instantaneously. Instead of sifting through lengthy spreadsheets or waiting for periodic reports, users can configure their dashboards to display the metrics that matter most to their roles and responsibilities.Imagine a sales manager’s dashboard.

It could prominently feature real-time sales figures against targets, average deal size, conversion rates by lead source, and customer acquisition cost. A finance director’s dashboard might highlight cash on hand, accounts receivable aging, current month’s expenses versus budget, and profit margins by product line. This immediate access to relevant data fosters a proactive approach. When a KPI deviates from its expected trend, the responsible individual can investigate the root cause immediately, rather than discovering the issue days or weeks later when it might be more difficult to rectify.Data visualization transforms raw numbers into easily digestible graphical representations, such as charts, graphs, and heatmaps.

A line graph showing sales revenue over the past twelve months can quickly reveal seasonal patterns or the impact of a recent marketing campaign. A bar chart comparing actual expenses to budgeted amounts can highlight areas of overspending at a glance. Pie charts can illustrate the breakdown of revenue by product category or customer segment. This visual storytelling of data makes complex information accessible to a wider audience within the organization, promoting data literacy and shared understanding of business performance.

The ability to drill down into these visualizations for more granular detail further enhances their utility, allowing users to explore the underlying data points that contribute to the overall picture. For example, clicking on a particular month in a sales trend graph might reveal the specific sales transactions that occurred during that period. This immediate, visual, and interactive access to critical business information is a cornerstone of effective, agile decision-making in today’s fast-paced commercial environment.

Hypothetical Scenario: Uncovering Hidden Trends and Opportunities with Sophisticated Business Intelligence

Consider “Aura Apparel,” a mid-sized clothing retailer that relies on its integrated accounting and business management software for day-to-day operations. While their sales are generally good, they’ve been struggling to pinpoint why certain product lines underperform and how to better manage their inventory. Using the software’s sophisticated business intelligence (BI) features, Aura Apparel’s management team decides to delve deeper into their sales, inventory, and customer data.The BI tools allow them to create a custom report that cross-references sales data with inventory levels and customer demographics.

They begin by analyzing sales by product category and then segmenting this further by customer age group and geographical region. They discover a surprising trend: while their overall sales of formal wear are declining, there’s a significant surge in demand for smart-casual attire among the 25-35 age demographic in urban areas. This insight is not immediately obvious from their standard monthly sales reports, which aggregate data too broadly.Next, they examine inventory turnover rates for these categories.

They find that their stock of formal wear, despite declining sales, is sitting idle for extended periods, tying up significant capital. Conversely, the smart-casual items that are in high demand are frequently selling out, leading to lost sales opportunities and customer frustration. The BI system, by correlating sales velocity with inventory levels, highlights this critical mismatch.Further analysis using customer purchase history reveals that customers who buy smart-casual items are also more likely to purchase accessories like scarves and watches.

This suggests a cross-selling opportunity that was previously overlooked. The BI tool can even identify the most frequent combinations of purchases, allowing Aura Apparel to strategically bundle these items or promote them together in marketing campaigns.The software’s predictive analytics module, fed by this historical data, forecasts a continued upward trend in smart-casual wear demand and a persistent decline in formal wear sales over the next two years.

This allows Aura Apparel to make proactive decisions. They can initiate a clearance sale for their formal wear inventory, reducing holding costs and freeing up cash. Simultaneously, they can increase orders for smart-casual items and related accessories, ensuring they meet the growing demand and maximize revenue. They can also tailor marketing efforts to specific urban demographics, promoting the smart-casual range through channels they know this group frequents.

This hypothetical scenario illustrates how integrated BI features can move beyond simple reporting to uncover hidden patterns, identify previously unseen opportunities, and drive strategic adjustments that lead to increased profitability and operational efficiency.

Leveraging Analytical Tools for Forecasting, Cost Savings, and Resource Optimization

Businesses of all sizes are increasingly leveraging the advanced analytical capabilities within integrated accounting and business management software to move from reactive management to proactive strategic planning. These tools empower organizations to forecast future performance with greater accuracy, identify potential cost-saving measures, and optimize the allocation of their valuable resources.Forecasting future performance is a critical aspect of business planning. By analyzing historical sales data, market trends, and economic indicators, businesses can use the software’s predictive analytics modules to generate more reliable revenue forecasts.

For instance, a manufacturing company might use historical production volumes, raw material costs, and projected demand from their sales forecasts to predict future production needs and associated expenses. This allows them to anticipate potential shortfalls or surpluses in raw materials and adjust procurement strategies accordingly. Similarly, a retail business can forecast seasonal sales peaks and troughs, enabling them to plan staffing levels and inventory procurement more effectively, thereby avoiding stockouts during high-demand periods and reducing excess inventory costs during slower seasons.

A prime example is how e-commerce giants use sophisticated algorithms, often powered by integrated analytics, to predict consumer buying patterns and adjust inventory across their fulfillment centers, ensuring timely delivery and minimizing logistical costs.Identifying cost-saving measures is another significant benefit. By analyzing expense data across various departments and cost centers, businesses can pinpoint areas of inefficiency or overspending. The software can generate detailed reports on expenditure trends, allowing managers to compare actual spending against budgets and identify deviations.

For example, a logistics company might analyze fuel consumption data across its fleet, identifying vehicles or routes with unusually high fuel usage. This could prompt an investigation into driver behavior, vehicle maintenance, or route optimization, leading to substantial fuel savings. Another example is a service-based business that analyzes labor costs by project. If certain projects consistently exceed their labor budget, the analytics can highlight this, prompting a review of project scope, resource allocation, or pricing for future engagements.Optimizing resource allocation is intrinsically linked to both forecasting and cost savings.

Once future needs are forecasted and areas for cost reduction are identified, businesses can strategically allocate their financial, human, and material resources. For instance, a software development company might use its project management and financial analytics to determine which projects are most profitable and have the highest potential for future growth. Based on this analysis, they can allocate more development resources and marketing budget to these high-potential projects, while potentially scaling back investment in less promising ventures.

This ensures that limited resources are directed towards activities that will yield the greatest return on investment. Furthermore, by analyzing employee productivity data and project timelines, businesses can optimize workforce deployment, ensuring that the right people are assigned to the right tasks at the right time, maximizing efficiency and minimizing idle time. This holistic approach, enabled by robust analytics, allows businesses to operate more leanly, adapt more readily to market changes, and ultimately achieve greater profitability and sustainable growth.

Seamless integration of accounting and business management software with other critical business applications.

In today’s interconnected business environment, the true power of accounting and business management software is unlocked when it harmoniously collaborates with other essential systems. This seamless integration moves beyond standalone functionality, creating a unified ecosystem where data flows freely, fostering efficiency, enhancing decision-making, and providing a comprehensive view of operations. The ability of your core financial and management platform to communicate with other specialized applications is no longer a luxury but a fundamental requirement for businesses aiming to thrive and remain competitive in the modern commercial landscape.

This interconnectedness minimizes manual data entry, reduces the risk of errors, and ensures that all departments are working with consistent and up-to-date information.The strategic advantage of integrating accounting and business management software with other critical business applications lies in its capacity to break down data silos and foster a holistic operational perspective. When different software solutions can communicate and share information effectively, businesses gain a more accurate and complete understanding of their performance across various functions.

This synergy not only streamlines day-to-day operations but also empowers leadership with the insights needed to make informed strategic decisions. The cumulative effect is a more agile, responsive, and ultimately, more profitable enterprise, capable of adapting quickly to market changes and customer demands.

Integrating Financial Software with Customer Relationship Management (CRM) Systems

The integration of accounting and business management software with Customer Relationship Management (CRM) systems offers a profound advantage by providing a truly holistic view of client interactions and their associated financial history. This synergy transforms how businesses understand, engage with, and serve their customers. By linking CRM data, such as sales leads, customer communications, support tickets, and contract details, directly with accounting records, companies can achieve unprecedented visibility.

Sales teams can instantly access a client’s payment history, outstanding balances, and past purchase details before making a sales call, allowing for more informed and personalized conversations. Conversely, finance departments can see the full lifecycle of a customer relationship, from initial lead generation to final payment, offering a richer context for financial analysis and forecasting.This unified perspective facilitates proactive customer service and financial management.

For instance, if a customer expresses dissatisfaction, the support team can immediately see if there are any pending invoices or overdue payments that might be contributing to the issue, enabling a more targeted and effective resolution. Similarly, marketing campaigns can be better tailored by segmenting customers based on their purchasing behavior and financial standing, as reflected in the integrated system.

The benefits extend to improved cash flow management, as sales projections from the CRM can be more accurately translated into revenue forecasts within the accounting system. Furthermore, dispute resolution becomes more efficient, as all relevant information, from order details to payment status, is readily accessible in one place. This integration fosters stronger customer loyalty by enabling businesses to anticipate needs, resolve issues swiftly, and offer personalized financial arrangements, ultimately driving increased revenue and profitability.

The unified view ensures that every customer interaction is informed by a complete understanding of their relationship with the company, both operationally and financially.

Connecting with E-commerce Platforms for Automated Processes

The benefits of connecting accounting and business management software with e-commerce platforms are substantial, primarily revolving around the automation of order processing, inventory updates, and sales reconciliation. In the digital marketplace, where transactions occur at high velocity, manual intervention in these processes quickly becomes a bottleneck, leading to errors, delays, and lost revenue. By establishing a direct link between the e-commerce storefront and the back-office accounting system, businesses can automate the flow of critical data.

When a customer places an order online, the system can automatically generate a sales order within the accounting software, deduct the items from inventory levels, and initiate the fulfillment process. This eliminates the need for manual data entry, significantly reducing the risk of transposed numbers, missed orders, or incorrect stock counts.This automation has a direct impact on inventory management. Real-time updates ensure that stock levels displayed on the e-commerce site accurately reflect the actual inventory, preventing overselling and the subsequent customer dissatisfaction and potential order cancellations.

As orders are processed and fulfilled, the inventory system is automatically adjusted, providing an accurate picture of available stock for future sales. Furthermore, sales reconciliation becomes a far more streamlined process. Instead of manually cross-referencing sales reports from the e-commerce platform with bank statements and accounting entries, the integrated system can automatically match transactions, flag discrepancies, and generate accurate financial reports.

This not only saves considerable time and resources but also improves the accuracy of financial statements and tax reporting. The ability to automate these core e-commerce functions allows businesses to scale their online operations more effectively, handle higher volumes of orders without a proportional increase in administrative overhead, and focus their human resources on more strategic tasks like customer service, marketing, and business development.

Schematic Illustrating Data Flow: Accounting, Payroll, and HR Platforms

To visualize the interconnectedness of accounting software, payroll systems, and human resources management (HRM) platforms, consider a schematic that depicts the flow of information essential for managing an organization’s workforce and its associated financial implications. This integration is crucial for ensuring accuracy, compliance, and operational efficiency.The schematic begins with the Human Resources Management Platform as the primary source for employee data.

When a new employee is hired, their personal details, contact information, tax identification numbers, bank account details for direct deposit, and employment status are entered into the HRM system. This foundational data then flows into the Payroll System. The Payroll System utilizes this information to calculate gross pay based on hours worked, salary, overtime, and any applicable bonuses or commissions.

Simultaneously, the HRM system might track employee leave, such as sick days or vacation, which also feeds into the payroll calculations to ensure accurate deductions or payments.The Payroll System then processes the net pay after deducting taxes, social security contributions, health insurance premiums, retirement plan contributions, and other statutory or voluntary deductions. These deduction details, along with the gross and net pay figures, are then sent to the Accounting Software.

Within the accounting system, these payroll expenses are recorded as journal entries, impacting various general ledger accounts, such as salaries and wages expense, payroll taxes payable, and accrued liabilities for benefits.Furthermore, the Accounting Software will record the actual disbursement of funds, including the total payroll run, to the appropriate bank accounts. The Payroll System often generates reports for tax filings (e.g., W-2s, 941s), which are then referenced or integrated with accounting for reconciliation and reporting purposes.

Similarly, information regarding employee benefits managed by HR, such as health insurance costs or 401(k) contributions, is often passed to accounting to ensure accurate financial reporting and budgeting. This bidirectional flow ensures that HR data informs payroll, payroll data informs accounting, and accounting data provides a financial overview of labor costs.

| Source System | Data Transferred | Destination System | Purpose |

|---|---|---|---|

| HRM Platform | Employee Personal Details, Bank Info, Tax IDs, Employment Status | Payroll System | Employee onboarding and setup for payroll processing |

| HRM Platform | Leave Records (Sick, Vacation) | Payroll System | Accurate calculation of pay and deductions |

| Payroll System | Gross Pay, Deductions (Taxes, Benefits, etc.), Net Pay | Accounting Software | Recording payroll expenses, liabilities, and cash outflows |

| Payroll System | Tax Filing Information (e.g., W-2, 941 data) | Accounting Software (for reconciliation/reporting) | Ensuring accurate tax liabilities and compliance |

| HRM Platform | Benefit Costs (e.g., Insurance Premiums) | Accounting Software | Accurate financial reporting and budgeting of labor costs |

| Accounting Software | Approved Payroll Disbursements | Banking System (via Payroll System or directly) | Execution of payments to employees |

Strategies for Ensuring Data Integrity and Security During Integration

Ensuring data integrity and security during the integration of multiple software solutions is paramount to maintaining trust, compliance, and operational reliability. Without robust strategies, the benefits of integration can be quickly overshadowed by data corruption, unauthorized access, or system vulnerabilities. A proactive and multi-layered approach is essential.One of the foundational strategies is establishing clear data mapping and transformation rules. Before any integration begins, a thorough analysis of the data fields in each system must be conducted.

This involves identifying corresponding fields, understanding data formats, and defining how data will be transformed if necessary to ensure consistency across systems. For example, a customer ID might be formatted differently in a CRM and an accounting system, requiring a transformation rule to standardize it. This meticulous mapping prevents data misinterpretation and ensures that information is accurately transferred.Data validation is another critical component.

Implementing validation checks at the point of data entry and during the transfer process helps to catch errors early. This can include checking for required fields, verifying data types (e.g., ensuring a number field contains only numbers), and enforcing business rules. For instance, an integration might be programmed to reject any order where the total value exceeds a predefined limit without proper authorization.

Automated data reconciliation processes should be in place to regularly compare data across integrated systems, flagging any discrepancies for immediate investigation.Security protocols must be rigorously applied throughout the integration lifecycle. This begins with secure authentication and authorization mechanisms. Only authorized users and systems should have access to the integrated data. This often involves using APIs (Application Programming Interfaces) with secure credentials, tokens, or OAuth protocols.

Data in transit must be encrypted using protocols like TLS/SSL to prevent eavesdropping or interception. Data at rest, within each system and any intermediate data staging areas, should also be encrypted. Regular security audits and vulnerability assessments of the integrated systems are crucial to identify and address potential weaknesses.Furthermore, establishing a comprehensive data governance policy is vital. This policy should Artikel data ownership, access controls, retention policies, and disaster recovery plans.

Implementing robust backup and recovery procedures ensures that data can be restored in the event of a system failure or cyberattack. Version control for integration scripts and configurations also plays a role in managing changes and reverting to previous stable states if issues arise. Finally, continuous monitoring of the integration points for performance anomalies, error rates, and security alerts provides an early warning system for potential problems, allowing for swift remediation and maintaining the overall integrity and security of the interconnected business systems.

Addressing the challenges and best practices associated with adopting and managing accounting and business management software.

Implementing new accounting and business management software can be a transformative step for any organization, promising enhanced efficiency and better decision-making. However, this journey is rarely without its obstacles. Recognizing and proactively addressing these common challenges is crucial for a smooth transition and for maximizing the long-term benefits of the chosen solution. This section delves into the typical hurdles businesses encounter and Artikels best practices for overcoming them, ensuring a successful adoption and ongoing effective management of the software.

Common Hurdles in Software Implementation

Businesses embarking on the implementation of new accounting and business management software often encounter a predictable set of challenges that can derail even the best-laid plans if not anticipated and managed effectively. These hurdles span technical, human, and strategic dimensions, each requiring specific attention and mitigation strategies.One of the most significant and frequently underestimated challenges is data migration. Moving historical financial data, customer records, vendor information, and inventory details from legacy systems to the new platform can be a complex and time-consuming process.

Inaccurate or incomplete data migration can lead to significant operational disruptions, erroneous financial reporting, and a loss of confidence in the new system from the outset. Issues often arise from differing data formats, missing fields, duplicate entries, and the sheer volume of data involved. Ensuring data integrity requires meticulous cleansing, validation, and mapping exercises before the actual migration.Another prevalent obstacle is user adoption resistance.

Employees, accustomed to existing workflows and familiar tools, may view the new software with apprehension, seeing it as an added burden or a threat to their established routines. This resistance can manifest as reluctance to learn the new system, continued reliance on old methods, or outright refusal to engage with the software. Overcoming this requires clear communication about the benefits of the new system, involving users in the selection and implementation process, and providing ample support and training.

Without buy-in from the end-users, the most sophisticated software will fail to deliver its intended value.The training requirements associated with new software are often more extensive than initially anticipated. Employees at all levels will need to understand how to navigate the system, perform their specific tasks, and leverage its advanced features. Inadequate or insufficient training can lead to errors, inefficiencies, and frustration, further fueling user adoption resistance.

The training needs to be tailored to different user roles and skill levels, and it should extend beyond the initial rollout to include ongoing support and advanced training as users become more proficient. The complexity of modern accounting and business management software, with its integrated modules and sophisticated analytics, necessitates a robust and continuous training strategy.Furthermore, integration with existing systems can present a technical hurdle.

Many businesses rely on a suite of applications for various functions, such as CRM, inventory management, or e-commerce platforms. Ensuring that the new accounting and business management software can seamlessly communicate and share data with these other critical applications is paramount. Incompatible systems or a lack of robust integration capabilities can create data silos, manual workarounds, and a fragmented view of business operations, undermining the very purpose of integrated software.Finally, budgetary constraints and scope creep can also pose significant challenges.

Initial cost estimates may not account for all the necessary customizations, training, and ongoing support, leading to budget overruns. Similarly, the desire to add more features or functionalities during the implementation phase, known as scope creep, can delay the project and increase costs without necessarily adding proportionate value. A clear understanding of the project scope and a disciplined approach to managing changes are essential to keep the implementation on track and within budget.

Essential Steps for a Successful Software Rollout

A well-executed software rollout is foundational to realizing the full potential of any new accounting and business management system. It requires a structured, phased approach that prioritizes planning, stakeholder involvement, and rigorous testing. By following a series of essential steps, organizations can significantly mitigate risks and ensure a smooth transition that maximizes user adoption and operational efficiency.The journey begins with thorough planning and requirement gathering.

This involves defining clear objectives for the software implementation, identifying key performance indicators (KPIs) that will measure success, and thoroughly documenting all business processes that the software will support. Stakeholder involvement is critical at this stage, ensuring that the needs of all departments, from finance and operations to sales and customer service, are understood and addressed. A detailed project plan, including timelines, resource allocation, and responsibilities, should be developed, outlining every phase of the rollout.

This initial planning phase is where the foundation for success is laid.Following the planning stage, a phased implementation is often the most effective strategy. Instead of attempting to deploy all modules and functionalities at once, a phased approach allows for a more controlled and manageable rollout. This might involve implementing core accounting functions first, followed by inventory management, then sales order processing, and so on.

Each phase can be thoroughly tested and refined before moving on to the next, allowing users to adapt gradually and providing opportunities to address any issues that arise in a contained manner. This iterative process minimizes disruption and allows for continuous learning and improvement throughout the rollout.Crucially, comprehensive user training must be an integral part of every phase. Training should not be a one-time event but an ongoing process that evolves with the implementation.

It should be tailored to different user roles and skill levels, utilizing a variety of methods such as classroom sessions, online modules, hands-on workshops, and user manuals. The training should focus not only on how to use the software but also onwhy* certain processes are important and how the software supports strategic business goals. Post-implementation support, including help desks and readily available resources, is also vital to ensure users feel confident and empowered.

Data migration and validation must be meticulously managed. Before migrating any data, a thorough data cleansing process is essential to identify and rectify errors, duplicates, and inconsistencies in the existing data. Data mapping, which defines how data from the old system will correspond to fields in the new system, needs to be precise. A pilot migration with a subset of data is highly recommended to test the migration process and identify potential issues before a full-scale migration.

Post-migration, rigorous validation is required to ensure all data has been transferred accurately and completely. Testing and quality assurance are paramount throughout the rollout. This includes unit testing of individual modules, integration testing to ensure different components work together seamlessly, and user acceptance testing (UAT) where end-users test the system in real-world scenarios. UAT is particularly important for identifying any usability issues or process gaps that might have been overlooked during the planning phase.

Feedback from UAT should be used to make necessary adjustments before the system goes live.Finally, a post-implementation review and continuous improvement strategy are essential. Once the software is live, it’s important to conduct a review to assess whether the initial objectives have been met and to identify any lessons learned. Ongoing monitoring of system performance, user feedback, and key performance indicators will help to identify areas for further optimization and ensure that the software continues to meet the evolving needs of the business.

This commitment to continuous improvement ensures the software remains a valuable asset over time.

Ongoing Maintenance and Update Procedures

The successful adoption of accounting and business management software is not a one-time event but an ongoing commitment to its maintenance and evolution. Ensuring the software remains secure, compliant, and efficient requires a proactive and systematic approach to regular maintenance and updates. Neglecting these procedures can expose the organization to security vulnerabilities, compliance risks, and a decline in operational performance, diminishing the initial investment.A cornerstone of ongoing maintenance is regular software updates and patching.

Software vendors frequently release updates that address bugs, introduce new features, and, most importantly, patch security vulnerabilities. These updates are critical for protecting the system from cyber threats, such as malware, ransomware, and unauthorized access. Organizations must establish a process for monitoring vendor release notes, testing updates in a sandbox environment before deploying them to production, and scheduling updates during off-peak hours to minimize disruption.

A robust patch management policy ensures that the software remains protected against emerging threats. Data backup and disaster recovery procedures are equally vital. Regular, automated backups of all critical data must be performed and stored securely, ideally in an off-site location or a cloud-based solution. These backups serve as a safety net in case of hardware failure, data corruption, cyber-attack, or natural disaster. A well-defined disaster recovery plan should Artikel the steps for restoring data and resuming operations in the event of a major incident, including regular testing of the recovery process to ensure its effectiveness.

User access management and security audits are ongoing necessities. As employees join, leave, or change roles within the organization, their access privileges to the software must be reviewed and updated accordingly. Implementing the principle of least privilege, where users are granted only the access necessary to perform their job functions, is a key security best practice. Regular security audits, both internal and external, can help identify any unauthorized access attempts, misconfigurations, or policy violations, ensuring the integrity and confidentiality of sensitive financial data.

Performance monitoring and optimization are crucial for maintaining efficiency. Over time, as data volumes grow and user activity increases, the software’s performance can degrade. Implementing monitoring tools to track key performance indicators such as response times, transaction processing speed, and system resource utilization allows for early detection of potential bottlenecks. Proactive adjustments, such as optimizing database queries, archiving old data, or upgrading hardware, can prevent performance issues from impacting productivity.

Compliance checks and regulatory updates are an integral part of managing accounting software. Accounting standards and tax regulations are subject to change, and the software must be configured to reflect these updates. Vendors typically provide updates to ensure compliance, but it is the organization’s responsibility to ensure these updates are applied and that internal processes align with current regulations. Regular reviews of financial reporting and compliance procedures are necessary to identify any discrepancies or areas requiring adjustment.Finally, regular system reviews and user feedback contribute to continuous improvement.

Periodically reviewing the software’s configuration, workflows, and feature utilization can identify opportunities for further optimization or the adoption of new functionalities that could enhance efficiency. Actively soliciting feedback from end-users about their experience with the software can highlight usability issues, training gaps, or unmet needs, providing valuable insights for ongoing enhancements and ensuring the software remains aligned with business requirements.

Measuring the Return on Investment (ROI), Accounting and business management software

Quantifying the return on investment (ROI) for accounting and business management software is essential for justifying the initial expenditure and demonstrating its ongoing value to the organization. This involves a systematic approach to identifying and measuring key performance indicators (KPIs) and operational improvements that directly result from the software’s implementation and effective utilization. Without a clear understanding of the ROI, it becomes challenging to make informed decisions about future investments and to advocate for the continued support of the software.A fundamental aspect of measuring ROI is through improved operational efficiency.

This can be quantified by tracking reductions in manual effort and time spent on various accounting and administrative tasks. For instance, a key performance indicator could be the reduction in time spent on accounts payable processing, accounts receivable collection, or payroll preparation. If a company previously spent 40 hours per week on manual invoice processing and now, with automated workflows, it takes only 10 hours, this represents a significant saving in labor costs and allows employees to focus on more strategic activities.

Similarly, a decrease in the time required to close the books at the end of a reporting period is a direct indicator of efficiency gains.Another significant contributor to ROI is enhanced accuracy and reduced errors. Traditional manual processes are prone to human error, leading to costly mistakes in financial reporting, compliance, and decision-making. By implementing integrated software, businesses can significantly reduce these errors.

KPIs to track here might include a reduction in the number of financial statement adjustments required, a decrease in late payment penalties due to improved accuracy in billing, or a lower incidence of inventory discrepancies. The cost of rectifying errors, including lost revenue, penalties, and reputational damage, can be substantial, and the software’s ability to minimize these is a direct financial benefit.

Improved decision-making through advanced reporting and analytics is a critical, albeit sometimes harder to quantify, component of ROI. Integrated software provides real-time access to financial data and offers sophisticated reporting tools that can generate insights into business performance, profitability, cash flow, and key operational metrics. By tracking the impact of these insights on strategic decisions, an ROI can be demonstrated. For example, if improved sales forecasting capabilities, enabled by the software, lead to a 5% reduction in excess inventory carrying costs, this is a measurable financial benefit.

Similarly, if enhanced profitability analysis leads to more effective pricing strategies that increase profit margins, this directly contributes to the ROI. Cost savings through better resource management and compliance also play a vital role. Integrated software can provide better visibility into resource utilization, helping businesses to identify areas of overspending or underutilization. For instance, improved inventory management can lead to reduced stockouts and less obsolete inventory, directly saving costs.

Furthermore, the software’s ability to ensure compliance with tax regulations and accounting standards can prevent costly fines and penalties. A reduction in the amount spent on external auditors for routine compliance checks, or the avoidance of fines related to tax errors, are tangible cost savings that contribute to the ROI.The formula for calculating ROI in this context can be broadly represented as:

ROI = [(Total Benefits – Total Costs) / Total Costs] – 100%

Where:

- Total Benefits include all quantifiable improvements such as labor cost savings, error reduction savings, increased revenue from better decisions, and cost avoidance (e.g., penalties).

- Total Costs include the initial software purchase or subscription fees, implementation costs, training expenses, ongoing maintenance and support fees, and any hardware upgrades required.

By meticulously tracking these KPIs and operational improvements, and by comparing them against the total investment, organizations can effectively demonstrate the tangible financial benefits and strategic advantages derived from their accounting and business management software.

Final Wrap-Up

In essence, accounting and business management software is no longer a mere tool for bookkeeping; it’s a strategic imperative. From optimizing daily tasks through automation to providing deep insights for future planning, these integrated systems empower businesses to navigate complexity with greater confidence. Embracing this technology is key to fostering growth, ensuring compliance, and maintaining a competitive edge in today’s dynamic marketplace.

Clarifying Questions

What is the primary benefit of integrated accounting and business management software?

The primary benefit is the creation of a single source of truth for financial and operational data, leading to improved efficiency, better decision-making, and reduced errors.

How does cloud-based software differ from on-premise software?

Cloud-based software is hosted on remote servers and accessed via the internet, offering flexibility and scalability, while on-premise software is installed and run on a company’s own servers, providing greater control but requiring more IT infrastructure.

Can small businesses afford advanced accounting and business management software?

Yes, many vendors offer tiered pricing and scaled-down versions specifically designed for small and medium-sized businesses, focusing on essential features and affordability.

What is the role of AI and machine learning in this software?

AI and machine learning enhance capabilities like fraud detection, predictive analytics for cash flow forecasting, and automating compliance checks, thereby improving accuracy and efficiency.

How important is integration with other business applications?

Integration is crucial for a holistic view of business operations, enabling seamless data flow between systems like CRM, e-commerce platforms, and HR management, which prevents data silos and improves overall business intelligence.