QuickBooks project accounting offers a powerful framework for businesses to meticulously track, manage, and analyze the financial performance of individual projects. This comprehensive guide delves into the fundamental principles, practical implementation strategies, and advanced techniques for leveraging QuickBooks to achieve unparalleled financial oversight for your projects. We will explore how QuickBooks categorizes income and expenses, set up new projects, and gain insights into managing budgets and forecasting effectively.

The discussion will further clarify the distinctions between QuickBooks’ standard accounting features and its specialized project accounting capabilities. We will compare reporting functionalities, identify unique data fields, and demonstrate how to allocate overhead costs and track billable versus non-billable hours and expenses. This exploration is designed to provide a clear understanding of how to optimize QuickBooks for enhanced financial management and profitability on a project-by-project basis.

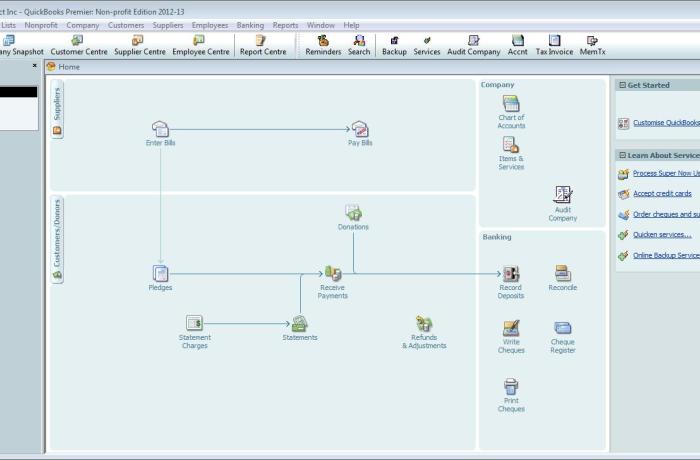

The fundamental principles of integrating project accounting within QuickBooks software are explored.

Integrating project accounting into QuickBooks offers a streamlined approach to managing finances for businesses that operate on a project-by-project basis. This integration allows for granular tracking of income and expenses, ensuring that each project’s profitability can be accurately assessed. At its core, QuickBooks project accounting is built upon the principle of segregation, enabling users to distinctly associate financial transactions with specific projects.

This not only aids in better cost control but also provides invaluable data for future bidding and resource allocation. The software’s design facilitates a clear view of where funds are coming from and where they are being spent, project by project, thereby enhancing financial transparency and accountability.The core functionalities of QuickBooks that support project-based financial tracking are multifaceted and designed to provide a comprehensive overview.

A primary feature is the ability to create unique “Jobs” or “Projects” within the system. These act as distinct entities to which all related income and expenses are assigned. This is crucial for understanding the financial performance of each undertaking independently. QuickBooks allows for the creation of custom fields, which can be leveraged to add project-specific information such as client names, project managers, or contract values, further refining the tracking process.

The software also excels in its ability to handle different types of project billing, including time and materials, fixed price, and progress billing, each with its own set of accounting implications. Furthermore, the reporting capabilities are a cornerstone of project accounting in QuickBooks. Users can generate detailed reports that break down costs, revenue, and profitability by project, offering insights that are vital for informed decision-making.

The system’s invoicing and bill payment features are also project-aware, allowing for the direct linking of invoices and bills to specific projects, ensuring that all financial movements are accounted for within the project context.

Categorizing Income and Expenses for Individual Projects

QuickBooks facilitates the meticulous categorization of income and expenses for individual projects through a structured system of accounts and project assignment. This ensures that every financial transaction can be precisely linked to its corresponding project, providing a clear financial picture for each undertaking. The software allows for the creation of a chart of accounts that can be further refined by assigning transactions to specific “Jobs” or “Projects.” When a sale is made or an invoice is generated, the user selects the relevant project from a dropdown menu, ensuring that the income is attributed to that particular project.

This is fundamental for tracking revenue generated by each project. Similarly, when expenses are incurred, such as for materials, labor, or subcontractor payments, these can be directly linked to a specific project through vendor bills or check transactions. This direct assignment is key to understanding the cost structure of each project.The system supports the creation of sub-accounts within the chart of accounts, which can be used to further categorize expenses specific to a project.

For instance, under a general “Project Expenses” account, one might have sub-accounts for “Materials,” “Labor,” “Subcontractors,” and “Travel.” When recording an expense, the user selects the primary expense category and then assigns it to the relevant project. This hierarchical categorization provides a detailed breakdown of where project funds are being utilized. For time-based projects, QuickBooks can track employee or contractor hours and associate them with specific tasks within a project, which are then translated into billable labor costs.

This ensures that labor expenses are accurately reflected against the project they support. The software’s ability to handle multiple currencies and tax rates also adds another layer of categorization, especially for projects that involve international clients or suppliers. This meticulous approach to categorizing both income and expenses is what allows businesses to move beyond simple bookkeeping and engage in true project financial management, identifying profitable projects and areas where costs might be exceeding expectations.

Setting Up a New Project in QuickBooks for Accounting Purposes, Quickbooks project accounting

Setting up a new project in QuickBooks for accounting purposes is a straightforward process that lays the groundwork for accurate financial tracking. The initial step involves navigating to the area where projects are managed. In QuickBooks Desktop, this is typically done by going to “Customers” > “Job List” > “New Job.” In QuickBooks Online, it’s usually found under “Sales” > “Customers” and then selecting a customer, followed by clicking “Add Job.” Once the “New Job” or “Project” window is open, the user will need to enter essential information.

The most critical piece of information is the Project Name, which should be descriptive and easily identifiable. It’s also important to link the project to the correct customer. If the customer doesn’t already exist in QuickBooks, they can be added at this stage.Next, users can input additional details that will aid in project management. This might include a Project Description, a Start Date, and an Estimated End Date.

For projects with a fixed price, the “Projected Revenue” or “Contract Amount” can be entered. This serves as a benchmark against which actual income and expenses will be measured. QuickBooks also allows for the assignment of a “Job Type,” which can be a pre-defined category like “Renovation,” “Consulting,” or “Software Development,” or a custom type created by the user. This further helps in organizing and reporting on projects.

If the project involves specific billing terms or a particular billing rate for labor, these can also be configured. For instance, if the project is billed at an hourly rate, the system can be set up to pull from pre-defined labor rates.A crucial step in the setup is ensuring that all subsequent transactions related to this project are correctly assigned.

This means that when creating invoices, bills, or entering expenses, the user must select the newly created project from the relevant dropdown menu. For advanced users, setting up specific “Cost Codes” or “Item Codes” that are exclusive to a project can provide even more granular tracking. This involves creating custom items in QuickBooks that represent specific project deliverables or cost categories, and then linking these items to the project.

By meticulously filling out these fields and understanding how to assign transactions, businesses can ensure that their QuickBooks system accurately reflects the financial status of each project, enabling effective monitoring and reporting.

Benefits of Using QuickBooks for Managing Project Budgets and Forecasting

Utilizing QuickBooks for managing project budgets and forecasting offers a significant advantage to businesses, particularly those in industries where project-based work is the norm. One of the primary benefits is the enhanced visibility it provides into project financial health. By accurately tracking all income and expenses against specific projects, QuickBooks allows managers to compare actual spending against the allocated budget in real-time.

This immediate insight is invaluable for identifying potential budget overruns early on, enabling proactive measures to be taken before they significantly impact profitability. The software’s ability to generate customizable reports, such as Budget vs. Actual reports, provides a clear, quantitative view of where a project stands financially.Furthermore, QuickBooks significantly improves the accuracy of project forecasting. When historical data from completed projects is readily available and well-categorized, it becomes a powerful tool for predicting the financial outcomes of future projects.

This data can inform more realistic budget estimations, helping businesses to bid more competitively and avoid underestimating costs. For instance, if a company has consistently found that a particular type of project incurs 15% more in material costs than initially budgeted, this insight, derived from QuickBooks data, can be used to adjust future budget projections accordingly. This predictive capability extends to cash flow forecasting as well, as users can anticipate future income and expenses based on project timelines and payment schedules, leading to better financial planning and resource allocation.The integration of project accounting within QuickBooks also streamlines the process of managing change orders.

When project scope changes, leading to adjustments in budget or timeline, QuickBooks can accommodate these modifications by updating project budgets and tracking the financial impact of the change. This ensures that the budget remains a living document, reflecting the current reality of the project. Additionally, the software’s reporting features can help in identifying trends across multiple projects. By analyzing data from various projects, businesses can gain a broader understanding of their financial performance, identify profitable project types, and pinpoint areas where operational efficiencies can be improved.

This strategic insight, powered by accurate and accessible project financial data within QuickBooks, is crucial for long-term business growth and sustainability.

Differentiating Between QuickBooks’ Standard Accounting Features and Its Specialized Project Accounting Capabilities

While QuickBooks is a robust accounting solution for businesses of all sizes, its core functionalities are designed for general financial management. However, it also offers specialized features that cater to the intricate needs of project-based businesses. Understanding these distinctions is crucial for leveraging QuickBooks effectively to track, manage, and analyze the financial performance of individual projects. This section delves into the specific ways QuickBooks separates its general accounting prowess from its project-centric capabilities, highlighting reporting differences, unique data fields, cost allocation methods, and the tracking of billable versus non-billable resources.

Reporting Capabilities: General Business Finances vs. Project-Specific Financial Reports

QuickBooks excels in providing comprehensive reporting for overall business health, offering standard financial statements that are vital for any enterprise. These include the Profit and Loss (P&L) statement, Balance Sheet, and Cash Flow Statement. The P&L, for instance, consolidates all revenue and expenses across the entire business for a given period, giving a bird’s-eye view of profitability. Similarly, the Balance Sheet provides a snapshot of assets, liabilities, and equity at a specific point in time, essential for understanding the company’s financial standing.

These reports are invaluable for tax preparation, investor relations, and strategic decision-making at a macro level.However, for businesses managing multiple projects, these general reports can obscure the financial performance of individual initiatives. This is where QuickBooks’ project accounting reporting shines. Project-specific reports allow users to drill down into the financial details of each project, providing a much more granular and actionable view.

Key project reports include:

- Project Profitability Report: This report details the revenue, costs, and ultimately, the profit or loss generated by a specific project. It allows project managers and business owners to quickly assess which projects are financially successful and which might be underperforming.

- Project Income by Customer Report: Useful for service-based businesses, this report shows the revenue generated from each project, often categorized by customer, helping to understand client profitability.

- Project Expenses by Vendor Report: This report itemizes expenses incurred for a particular project, broken down by vendor. This is critical for cost control and identifying potential areas for negotiation or efficiency improvements within a project.

- Job Progress Reports: While not strictly financial, these reports often tie into project accounting by showing the percentage of completion, which can be used to recognize revenue appropriately, especially for long-term projects.

The fundamental difference lies in the level of detail and focus. General reports offer a consolidated view, while project reports dissect financial data by project, enabling targeted analysis and informed management decisions specific to each undertaking. For example, a general P&L might show overall revenue, but a project P&L will reveal if Project Alpha is generating the expected profit margin, even if the overall company P&L looks healthy due to other profitable ventures.

This detailed insight is indispensable for managing budgets, forecasting, and making critical go/no-go decisions on projects.

Unique Data Fields and Tracking Mechanisms for Project Accounting

QuickBooks’ general ledger is designed to track financial transactions at an account level, such as revenue, expenses, assets, and liabilities. While powerful for overall financial reporting, it lacks the specific dimensions needed to isolate and analyze project-related financial activities. Project accounting in QuickBooks introduces a layer of specialized fields and tracking mechanisms that go beyond the standard chart of accounts.

These additions are fundamental to attributing income and expenses accurately to individual projects, which is often referred to as “job costing” in QuickBooks terminology.The most significant of these is the “Job” or “Project” field. When creating a new transaction (like an invoice, bill, or journal entry), users can assign it to a specific project. This is a custom field that is not part of the standard chart of accounts but is a primary attribute for project accounting.

This allows for the segregation of financial data directly at the transaction level.Beyond the primary project assignment, QuickBooks offers several other crucial tracking mechanisms:

- Classes: While classes can be used for various purposes, in project accounting, they can be employed to further categorize projects, perhaps by project type (e.g., “Residential,” “Commercial”) or by department responsible for the project. This adds another layer of segmentation for reporting and analysis.

- Customers: Projects are typically associated with a customer. QuickBooks’ robust customer tracking allows for the linkage of projects to specific clients, facilitating reports on customer profitability and project revenue per client.

- Items: For service-based projects, specific “items” can be set up to represent different services or billable labor categories. These items can be linked to specific revenue accounts and, importantly, can be designated as billable or non-billable, which is a critical component of project profitability tracking.

- Time Tracking: QuickBooks’ integrated time tracking feature is a cornerstone of project accounting. Employees can log their hours against specific projects and activities. This data is then directly linked to payroll expenses and can be billed to clients, providing an accurate cost basis for labor on each project.

- Expenses & Bills: When entering bills from vendors or recording expenses, the ability to assign these costs directly to a project is paramount. This includes materials, subcontractors, travel, and any other direct project expenditure.

These specialized fields and mechanisms are absent in the general ledger’s standard transaction entry. Without them, attributing costs and revenues to specific projects would be an arduous, manual process, prone to errors. For instance, a general expense for “Office Supplies” would simply hit the “Office Supplies Expense” account. However, if a portion of those supplies were used for Project X, the project accounting features allow you to allocate that specific expense to Project X, which is vital for accurate project cost accounting.

The ability to tag each transaction with a project identifier transforms raw financial data into actionable project insights.

Allocating Overhead Costs to Specific Projects

Allocating overhead costs to specific projects is a complex but essential aspect of true project accounting, and QuickBooks provides mechanisms to facilitate this, though it often requires a strategic approach. Overhead costs, such as rent, utilities, administrative salaries, insurance, and depreciation, are not directly tied to a single project but are necessary for the overall operation of the business. To understand the true profitability of a project, these indirect costs must be distributed appropriately.QuickBooks doesn’t have an automated, built-in “overhead allocation” feature in the same way it tracks direct costs.

Instead, businesses typically use journal entries and sometimes specific items or classes to achieve this allocation. The fundamental principle is to establish a reasonable basis for allocation and then systematically apply it. Common allocation methods include:

- Percentage of Direct Labor Costs: If labor is a significant direct cost for projects, overhead can be allocated based on the proportion of direct labor costs each project incurs. For example, if total direct labor costs are $100,000 and Project A incurs $20,000 in direct labor, it might be allocated 20% of the total overhead.

- Percentage of Direct Costs: Similar to labor, overhead can be allocated based on the total direct costs (labor, materials, subcontractors) incurred by each project.

- Square Footage: For businesses with physical space, overhead related to rent and utilities can be allocated based on the square footage dedicated to or used by a project, though this is more common for internal departments than project accounting.

- Direct Labor Hours: If labor hours are the primary driver of project activity, overhead can be allocated based on the number of direct labor hours spent on each project.

The process in QuickBooks typically involves:

1. Calculating Total Overhead

First, identify and sum up all eligible overhead expenses for a given period.

2. Determining the Allocation Basis

Choose a consistent and justifiable method for allocating these costs. This is often a strategic decision based on the business model.

3. Calculating the Allocation Amount per Project

Apply the chosen allocation basis to each project to determine how much overhead each should bear.

4. Recording the Allocation

This is usually done via a journal entry. The journal entry would debit an “Overhead Allocation Expense” account (which might be a sub-account of a larger overhead category or a dedicated project overhead account) for each project and credit a central overhead expense account (e.g., “Rent Expense,” “Utilities Expense”).For example, if a company has $50,000 in monthly overhead and decides to allocate it based on direct labor costs, and Project A had $10,000 in direct labor while Project B had $15,000, the total direct labor is $25,000.

Project A would be allocated $20,000 ($50,000($10,000/$25,000)) and Project B $30,000 ($50,000

($15,000/$25,000)). The journal entry would look something like

Debit: Project A Overhead Expense $20,000

Debit: Project B Overhead Expense $30,000

Credit: Rent Expense $30,000

Credit: Utilities Expense $20,000

By using the “Class” feature or custom fields associated with projects in the journal entry, these allocated overhead costs can then be reported alongside direct costs for each project, providing a more accurate picture of its true profitability. This meticulous allocation ensures that all business costs are accounted for, leading to better pricing strategies and more informed decisions about project selection and execution.

Tracking Billable vs. Non-Billable Hours and Expenses for Project Profitability

Accurately distinguishing between billable and non-billable time and expenses is fundamental to understanding project profitability and ensuring accurate client invoicing. QuickBooks offers robust features to manage this distinction, directly impacting a project’s financial success. This capability is crucial for service-based businesses, consulting firms, construction companies, and any organization where labor and materials are either directly charged to a client or are part of the operational cost of doing business.The process begins with time tracking.

When employees log their hours in QuickBooks, they can assign these hours to specific projects and, importantly, mark them as billable or non-billable. This is typically done through the time entry interface.

- Billable Time: Hours logged for activities that are directly performed for a client and for which the client will be invoiced. Examples include client consultations, project development, installation, and on-site work. When an employee marks time as billable, QuickBooks flags it for inclusion on future invoices.

- Non-Billable Time: Hours logged for internal tasks, administrative duties, training, or project management activities that are not directly charged to a client. While these hours represent a cost to the business, they do not generate direct revenue from a client. Examples include internal team meetings, professional development, or administrative support tasks.

Similarly, expenses can also be categorized as billable or non-billable when they are entered into QuickBooks.

- Billable Expenses: These are costs incurred on behalf of a client that are intended to be passed on to them, often with a markup. Examples include materials purchased specifically for a project, third-party services, or travel expenses directly related to a client’s project. When an expense is marked as billable, QuickBooks tracks it against the specific project and makes it available to be added to a client’s invoice.

- Non-Billable Expenses: These are operational costs that support the business and its projects but are not directly charged to a client. This could include general office supplies, general marketing expenses, or internal software subscriptions.

The real power of this feature emerges when generating invoices. QuickBooks can automatically pull all recorded billable time and expenses associated with a specific project and customer. Project managers can review these items before finalizing an invoice, ensuring accuracy and completeness.This tracking directly contributes to project profitability analysis in several ways:

- Accurate Invoicing: Ensures that clients are billed correctly for all services and expenses they are responsible for, maximizing revenue recovery.

- Cost Analysis: By separating billable from non-billable costs, businesses can better understand the true cost of delivering a project. High non-billable hours or expenses might indicate inefficiencies or a need to re-evaluate project scope or operational processes.

- Profit Margin Calculation: When billable revenue is compared against the total costs (both billable and non-billable direct costs, plus allocated overhead), a clearer picture of the project’s net profitability emerges.

- Resource Management: Identifying patterns in billable vs. non-billable time can help in optimizing team workloads and identifying areas where training or process improvements could increase billable utilization.

For instance, if a project has high billable revenue but low profitability, it might suggest that the billable rate is too low, the non-billable time is excessive, or overhead allocation is too high. QuickBooks’ ability to segment these elements provides the data needed to diagnose such issues and make informed adjustments to pricing, operational efficiency, or project management strategies.

Practical implementation strategies for leveraging QuickBooks for effective project accounting are presented.

Implementing project accounting effectively within QuickBooks involves a structured approach to manage project finances from inception to completion. This section delves into actionable strategies that businesses can adopt to harness QuickBooks’ capabilities for enhanced project oversight, client billing, vendor management, and profitability analysis. By adopting these practices, organizations can move beyond basic accounting and leverage QuickBooks as a powerful tool for strategic project financial management.

Client Invoicing Workflow Based on Project Milestones and Progress

Establishing a clear and efficient workflow for client invoicing is paramount for project-based businesses. This workflow ensures timely payments, maintains healthy cash flow, and provides clients with transparent billing that aligns with project deliverables. Leveraging QuickBooks for this process automates many steps, reduces manual errors, and allows for better tracking of revenue recognition against project progress. The key is to integrate project tracking with invoicing, ensuring that each invoice accurately reflects the work completed and the agreed-upon terms.

This system also helps in identifying potential delays or scope creep that might impact billing schedules, allowing for proactive communication with clients.A robust client invoicing workflow in QuickBooks typically involves the following steps:

- Setting Up Project Items: Before invoicing, ensure that each project is set up as a “Job” or “Project” within QuickBooks. Associated with this, create specific “Items” that represent billable services, materials, or phases of the project. These items should be linked to the appropriate revenue accounts and, crucially, to the specific project. This allows for granular tracking of costs and billable amounts per project.

- Tracking Billable Time and Expenses: As project work progresses, meticulously track all billable hours spent by employees and any reimbursable expenses incurred. QuickBooks offers features for time tracking and expense entry, which can be directly linked to specific projects and customers. This ensures that all legitimate costs and efforts are captured for billing.

- Defining Milestones and Billing Schedules: Work with clients to define clear project milestones and agree on a billing schedule. This could be based on completion of specific phases, delivery of key deliverables, or a percentage of project completion. Document these agreements in the project contract.

- Creating Progress Invoices: When a milestone is reached or a predetermined billing period concludes, create a progress invoice in QuickBooks. Select the customer and the associated project. QuickBooks will then allow you to add the billable time and expenses that have been tracked against that project since the last invoice. You can also manually enter a fixed amount if the billing is based on a lump sum for a milestone.

- Review and Approval: Before sending any invoice, a thorough review is essential. Verify that all tracked time and expenses are accurate and billable. Check that the invoice amount aligns with the agreed-upon milestone payment or billing schedule. This review process can involve a project manager and a finance team member.

- Sending Invoices and Tracking Payments: Once approved, send the invoice to the client. QuickBooks allows for sending invoices directly via email, often with a link for online payment if integrated with payment processors. Mark the invoice as “Sent” and then as “Paid” once payment is received. This keeps your accounts receivable up-to-date.

- Reconciliation and Reporting: Regularly reconcile payments received against outstanding invoices to ensure accuracy. Utilize QuickBooks’ reporting features to generate project-specific income reports, showing revenue recognized per project and comparing it against actual costs. This provides a clear picture of project profitability.

This systematic approach ensures that invoicing is not an afterthought but an integrated part of project management, directly reflecting the value delivered to the client and the progress made.

Vendor Payment and Subcontractor Cost Management System

Effective management of vendor payments and subcontractor costs is critical for maintaining project budgets and overall profitability. Without a structured system, costs can spiral, leading to budget overruns and financial strain. QuickBooks, when configured for project accounting, offers robust tools to track these expenses against individual projects, providing real-time visibility into where project funds are being allocated. This allows for better control over spending, negotiation with vendors, and accurate forecasting of remaining project costs.

The system should facilitate the capture of all project-related expenses, from raw materials to specialized subcontractor services, ensuring each is properly categorized and linked to the relevant project.Here’s a system for managing vendor payments and subcontractor costs within QuickBooks for projects:

- Establish Project-Specific Vendor/Subcontractor Accounts: While you might have overarching vendor accounts, it’s beneficial to use the “Jobs” or “Projects” feature in QuickBooks to tag each expense. When entering a bill or writing a check, ensure you select the correct customer/job. This is the cornerstone of attributing costs correctly. For recurring subcontractors, you can create specific vendor profiles and then tag their invoices to the relevant project.

- Create Detailed Expense Categories: Within your Chart of Accounts, create or utilize specific expense accounts that are relevant to project costs. Examples include “Subcontractor Labor – Project A,” “Materials – Project B,” “Equipment Rental – Project C,” or more generally, “Project Labor,” “Project Materials,” “Project Equipment.” The key is to have enough detail to analyze spending patterns per project but not so much that it becomes unmanageable.

- Process Bills and Payments Efficiently: When a vendor or subcontractor submits an invoice, enter it into QuickBooks as a “Bill.” Crucially, assign the bill to the correct “Customer:Job” and the appropriate expense account. This records the liability and allocates the cost to the project. When it’s time to pay, you can generate a “Pay Bills” report to see all outstanding project-related bills and select which ones to pay.

When paying, ensure the payment is also linked to the same Customer:Job.

- Track Purchase Orders (POs): For larger projects or significant purchases, utilize QuickBooks’ Purchase Order feature. Create a PO for anticipated expenses, linking it to the project. When the vendor’s invoice arrives, you can “Receive Items” against the PO, which helps track commitments and compare actual costs against budgeted amounts. This provides an early warning system for potential overruns.

- Manage Subcontractor Contracts and Payments: For subcontractors, ensure you have clear contracts outlining scope of work, payment terms, and deliverables. When entering their invoices, verify they align with the contract and the work performed. Consider using a “Subcontractor” class if you need to track all payments to subcontractors across multiple projects. However, assigning to the specific Job is generally more granular.

- Regular Budget vs. Actual Reporting: Frequently run “Project Profitability” or “Job Estimate vs. Actual” reports in QuickBooks. These reports will show your budgeted costs for each project against the actual vendor and subcontractor expenses incurred. This allows for immediate identification of projects that are trending over budget and enables timely corrective action.

- Reconcile Vendor Statements: Periodically, obtain statements from your key vendors and subcontractors and reconcile them against the bills entered in QuickBooks. This ensures that all invoices have been accounted for and that payments have been applied correctly, preventing discrepancies and potential late fees.

By implementing this structured approach, businesses can gain a comprehensive understanding of their project expenditures, enabling better financial control and more accurate project pricing for future endeavors.

Template for a QuickBooks Project Profitability Report

A robust project profitability report is the cornerstone of understanding the financial health of individual projects. In QuickBooks, this report can be customized to provide deep insights into revenue, costs, and ultimately, the net profit generated by each project. The goal is to move beyond simply tracking income and expenses and to clearly attribute them to specific projects, allowing for informed decision-making regarding resource allocation, pricing strategies, and identifying high-performing or underperforming projects.

A well-designed template will include key metrics that offer a holistic view of project financial performance.Here’s a template for a QuickBooks Project Profitability Report, detailing essential metrics:

QuickBooks Project Profitability Report Template

Report Name: Project Profitability Analysis

Date Range: [Specify Date Range – e.g., This Fiscal Year, Last Quarter, Project-to-Date]

Filter By: [e.g., All Projects, Specific Project Manager, Project Status]

| Metric | Description | QuickBooks Source/How to Obtain |

|---|---|---|

| Project Name | The unique identifier for each project. | “Customer:Job” field in QuickBooks transactions. |

| Project Start Date | The official commencement date of the project. | Custom field on the Customer/Job record or project management software. |

| Project End Date (or Estimated) | The projected or actual completion date. | Custom field on the Customer/Job record or project management software. |

| Total Revenue | The sum of all income recognized for the project during the specified period. This includes all invoiced amounts that have been paid or are considered earned. | “Sales by Job” report, filtered for revenue items. |

| Cost of Goods Sold (COGS) / Direct Project Costs | Direct expenses incurred to complete the project. This includes materials, direct labor, subcontractor costs, and project-specific equipment rentals. | “Job Costs by Job” report or a customized “Profit & Loss by Job” report, focusing on expense accounts linked to projects. |

| Gross Profit | Total Revenue minus Cost of Goods Sold. This indicates the profitability of the project before considering overhead. | Calculated: Total Revenue – COGS. |

| Gross Profit Margin (%) | Gross Profit divided by Total Revenue, expressed as a percentage. This is a key indicator of pricing efficiency and cost control. | Calculated: (Gross Profit / Total Revenue) – 100. |

| Operating Expenses (Allocated Overhead) | A portion of indirect costs (rent, utilities, administrative salaries) that are allocated to the project. This requires a defined overhead allocation methodology. | Requires manual allocation or a separate system if not directly tracked in QuickBooks via specific “overhead” items linked to projects. |

| Net Profit | Gross Profit minus Allocated Operating Expenses. This is the true profitability of the project after all expenses. | Calculated: Gross Profit – Operating Expenses. |

| Net Profit Margin (%) | Net Profit divided by Total Revenue, expressed as a percentage. This is the ultimate measure of project financial success. | Calculated: (Net Profit / Total Revenue) – 100. |

| Budgeted Revenue | The total revenue initially projected for the project. | Typically entered via “Estimates” in QuickBooks or a separate budget document. |

| Budgeted Costs | The total expenses initially projected for the project. | Typically entered via “Estimates” in QuickBooks or a separate budget document. |

| Variance (Revenue) | The difference between Budgeted Revenue and Actual Revenue. | Calculated: Actual Revenue – Budgeted Revenue. |

| Variance (Costs) | The difference between Budgeted Costs and Actual Costs. | Calculated: Actual Costs – Budgeted Costs. |

| Variance (Profit) | The difference between Budgeted Profit and Actual Profit. | Calculated: Actual Profit – Budgeted Profit. |

Notes on Implementation:

- Ensure all direct project costs (materials, labor, subcontractors) are accurately assigned to the correct “Customer:Job” when entering bills, expenses, or payroll.

- Utilize QuickBooks’ “Estimates” feature to input initial project budgets for revenue and costs. This data can then be compared against actuals.

- If overhead allocation is complex, consider using a separate spreadsheet or a more advanced accounting system, or develop a consistent allocation method within QuickBooks using specific items.

- Regularly update the report (e.g., weekly or monthly) to maintain an accurate view of project performance.

This template provides a comprehensive framework for understanding project financial performance, enabling better strategic decisions and improved profitability.

Procedures for Reconciling Project-Specific Bank Accounts and Credit Card Transactions

Reconciling bank accounts and credit card transactions is a fundamental accounting practice, but when applied to project-specific accounts, it becomes a powerful tool for financial control and accuracy. For businesses that dedicate specific bank accounts or credit cards to individual projects, or that meticulously tag all transactions to projects, reconciliation ensures that all financial activities are accounted for and accurately reflect project expenditures and income.

This process helps in identifying discrepancies, preventing fraud, and maintaining an up-to-date and reliable financial picture for each project. The key is to establish a consistent procedure that aligns with how project transactions are recorded in QuickBooks.Here are the procedures for reconciling project-specific bank accounts and credit card transactions in QuickBooks:

- Establish Dedicated Project Accounts or Tagging System:

- Option 1: Dedicated Accounts: If you use separate bank accounts or credit cards for major projects, ensure these are set up as distinct bank or credit card accounts within QuickBooks. This simplifies the reconciliation process as you’ll be reconciling each account independently.

- Option 2: Transaction Tagging: If you don’t have dedicated accounts, implement a strict policy of tagging every transaction to a specific “Customer:Job” in QuickBooks. This requires discipline during data entry for all expenses, deposits, and transfers.

- Gather Bank/Credit Card Statements: At the end of each reconciliation period (typically monthly), obtain the official bank or credit card statements for the accounts you are reconciling. Ensure these statements cover the entire period you intend to reconcile.

- Initiate Reconciliation in QuickBooks:

- Navigate to the “Banking” menu and select “Reconcile.”

- Choose the specific bank or credit card account you are reconciling from the dropdown list.

- Enter the ending balance as shown on your bank/credit card statement and the ending date of the statement.

- Match Transactions:

- QuickBooks will display a list of transactions from your account. Compare these transactions against the transactions recorded in your QuickBooks account for the same period.

- For each transaction that appears on both the statement and in QuickBooks, click on it to mark it as cleared.

- If using dedicated project accounts: Ensure that the QuickBooks transaction is linked to the correct project (Customer:Job). If a transaction appears on the statement but not in QuickBooks, or vice versa, you will need to investigate.

- If using transaction tagging: Verify that each expense or deposit on the statement has a corresponding entry in QuickBooks that is correctly assigned to a “Customer:Job” and the appropriate expense or income account.

- Investigate Discrepancies:

- The goal of reconciliation is for the “Difference” shown at the top of the reconciliation screen to be $0.00.

- If there is a difference, you need to find the cause. Common reasons include:

- Outstanding checks that haven’t cleared the bank yet.

- Deposits in transit that haven’t been credited by the bank.

- Transactions entered incorrectly in QuickBooks (wrong amount, date, or account).

- Transactions on the statement that were not entered into QuickBooks.

- Duplicate entries in QuickBooks.

- Bank fees or interest not recorded in QuickBooks.

- For project-specific accounts or tagged transactions, pay close attention to ensure that any discrepancies are correctly attributed to the relevant project or are general bank charges. For instance, a bank fee might need to be categorized as a general overhead expense if not project-specific.

- Record Unrecorded Transactions: If you find transactions on the bank statement that are not in QuickBooks (e.g., bank fees, interest earned, or forgotten expenses), you will need to enter them into QuickBooks. Ensure these new entries are correctly categorized and, if applicable, assigned to the appropriate “Customer:Job.”

- Finalize Reconciliation: Once the difference is $0.00, click “Reconcile Now.” QuickBooks will generate a Reconciliation Report. It is crucial to save or print this report for your records. This report serves as proof that the account has been reconciled and that your QuickBooks records match the bank’s records for the period.

- Review Project Profitability Reports Post-Reconciliation: After reconciling, run your project profitability reports again. The accurate bank and credit card data will ensure these reports reflect the true financial performance of your projects.

Consistent and diligent reconciliation of project-specific accounts or transactions is vital for maintaining financial integrity and providing accurate insights into project performance.

Advanced Techniques for Optimizing QuickBooks Project Accounting for Enhanced Financial Oversight

QuickBooks, while offering robust standard accounting features, truly shines for project-based businesses when its specialized project accounting capabilities are leveraged to their fullest. Moving beyond basic tracking, advanced techniques can unlock deeper insights, refine financial management, and ultimately contribute to more profitable project outcomes. This section delves into sophisticated methods for segmenting data, meticulously monitoring budgets, effectively managing work-in-progress, and generating impactful reports that speak directly to the needs of project stakeholders.

Custom Fields and Tags for Granular Project Data Segmentation

The power of QuickBooks for project accounting is significantly amplified by the strategic use of custom fields and tags. These features allow for a level of detail and flexibility that goes far beyond standard chart of accounts categories, enabling businesses to slice and dice project-related financial data in ways that are highly specific to their operational needs. By defining custom fields and tags, users can capture and analyze information at a much finer granularity, leading to more accurate cost allocation, better performance tracking, and more informed decision-making.

For instance, a construction company might use custom fields to track materials by vendor, labor by trade, or equipment by type, all within a specific project. This level of detail is crucial for identifying cost overruns, optimizing procurement, and understanding the true profitability of different project components. Similarly, marketing agencies can use tags to categorize expenses by campaign, channel, or client initiative, allowing them to assess the ROI of various marketing efforts with precision.

The ability to create custom fields and tags is not a one-time setup; it’s an ongoing process that should evolve with the business and its project types. Regularly reviewing and refining these fields ensures that they remain relevant and continue to provide valuable analytical insights. The key is to think about the specific questions you need answered about your projects and then design your custom fields and tags to facilitate those answers.

This proactive approach transforms QuickBooks from a mere bookkeeping tool into a powerful analytical engine for project finance.Consider a software development project. Without custom fields, all development hours might be lumped under a general labor cost. With custom fields, you could track:

- Development Hours (by role: Senior Developer, Junior Developer, QA Tester)

- Project Phase (e.g., Requirements Gathering, Design, Development, Testing, Deployment)

- Feature Set (e.g., User Authentication, Payment Gateway Integration, Reporting Module)

This allows for analysis such as “Which development role is consuming the most hours on the ‘Payment Gateway Integration’ feature during the ‘Development’ phase?” or “Is the ‘Testing’ phase for the ‘Reporting Module’ exceeding the allocated budget for QA hours?”Tags can be used to categorize expenses that might span multiple projects or cost centers, such as software subscriptions used across the organization or travel expenses for team meetings.

For example, a tag like “Software Licenses” can be applied to the expense line item, allowing you to see the total cost of all software licenses across all projects in a given period. This granular segmentation is invaluable for identifying trends, optimizing resource allocation, and providing detailed breakdowns to clients or management. The flexibility in defining these fields and tags means that QuickBooks can be tailored to virtually any industry or project structure, providing a personalized and powerful financial management solution.

Utilizing QuickBooks Budgeting Tools for Effective Project Spending Control

Effective project management hinges on the ability to set realistic budgets and rigorously monitor spending against them. QuickBooks offers a suite of budgeting tools that, when utilized strategically, provide project managers with the visibility and control needed to keep projects financially on track. These tools allow for the creation of detailed project-specific budgets, the comparison of actual expenditures against budgeted amounts, and the proactive identification of potential overruns before they become significant issues.

The process begins with setting up comprehensive budgets that reflect anticipated costs across all relevant categories for a given project. This involves forecasting expenses for labor, materials, subcontractors, equipment, travel, and any other project-related expenditures. Once established, QuickBooks’ budgeting features enable real-time tracking, allowing for continuous comparison of actual spending with the planned budget. This comparison is critical for maintaining financial discipline and making timely adjustments.The primary benefit of using QuickBooks budgeting tools is the early warning system they provide.

By regularly reviewing budget vs. actual reports, project managers can quickly spot areas where spending is exceeding expectations. This allows for immediate investigation into the causes of the overspending and the implementation of corrective actions, such as negotiating better rates with suppliers, reallocating resources, or adjusting project scope if necessary. Without this proactive monitoring, cost overruns can snowball, jeopardizing project profitability and potentially leading to financial losses.

Furthermore, the budgeting tools in QuickBooks facilitate forecasting and scenario planning. Project managers can use historical data and current project performance to refine future budget estimates, making them more accurate and reliable. This iterative process of budgeting, tracking, and refining improves financial planning capabilities over time.A practical application involves a marketing campaign project. A budget might be set for:

- Advertising Spend: $10,000

- Content Creation: $5,000

- Agency Fees: $8,000

- Contingency: $2,000

As the campaign progresses, QuickBooks can generate reports showing:

- Advertising Spend: $9,500 (Actual) vs. $10,000 (Budgeted)

- Content Creation: $6,200 (Actual) vs. $5,000 (Budgeted)

- Agency Fees: $7,800 (Actual) vs. $8,000 (Budgeted)

This immediate visibility shows that content creation is over budget by $1,200, prompting an investigation into why and how to mitigate further increases. The ability to set budgets at a granular level, often tied to specific cost categories or even individual project tasks, empowers project managers to maintain tight control over every aspect of project expenditure. This level of detail ensures that financial resources are used efficiently and effectively, maximizing the return on investment for each project undertaken.

Tracking Work-in-Progress (WIP) for Long-Term Projects

For projects that span extended periods, accurately tracking Work-in-Progress (WIP) is paramount for proper revenue recognition and financial reporting. QuickBooks provides mechanisms to manage WIP, ensuring that the value of work completed but not yet billed is appropriately reflected on financial statements. This is particularly crucial for industries like construction, consulting, or manufacturing, where projects often extend over months or even years.

By properly accounting for WIP, businesses can avoid understating revenue and expenses, providing a more accurate picture of the company’s financial health and project profitability at any given point in time. The core principle behind WIP accounting is to recognize revenue as it is earned, even if payment has not yet been received. This aligns with accrual accounting principles and provides a more faithful representation of economic activity.QuickBooks facilitates WIP tracking through several methods, often involving the use of specific accounts and transaction types.

One common approach is to use an asset account for WIP, where costs incurred on a project are accumulated. As invoices are generated for work completed, the corresponding WIP amount is reduced, and revenue is recognized. This ensures that the balance sheet accurately reflects the value of ongoing projects. Another method involves using a “Cost of Goods Sold” or “Cost of Sales” account in conjunction with revenue recognition.

As costs are incurred for a long-term project, they are posted to an expense account. When a portion of the project is completed and billed, the associated costs are then moved from the general expense account to a “Cost of Sales” account, matching the recognized revenue.Consider a large-scale construction project. Costs for materials, labor, and subcontractors are incurred over several months.

- Month 1: $50,000 in project costs are incurred.

- Month 2: Another $75,000 in project costs are incurred.

- At the end of Month 2, 30% of the project is deemed complete, and an invoice for $100,000 is issued.

Using WIP accounting in QuickBooks:

- The $50,000 and $75,000 would initially be tracked in a WIP asset account.

- Upon invoicing, $125,000 (the total costs incurred) would be recognized as Cost of Goods Sold, and $100,000 would be recognized as Revenue. The remaining costs ($125,000 – $100,000 = $25,000) would remain in the WIP asset account, representing the value of work completed but not yet billed.

This systematic approach ensures that financial statements reflect the true economic value of ongoing projects, providing stakeholders with reliable information for decision-making and performance evaluation. Proper WIP management is not just a compliance requirement; it’s a strategic tool for understanding project lifecycle costs and profitability.

Generating Comprehensive Financial Summaries for Project Stakeholders

The ultimate goal of meticulous project accounting is to provide clear, concise, and actionable financial information to all relevant stakeholders. QuickBooks’ reporting capabilities are instrumental in achieving this, allowing for the generation of a wide array of reports that can be customized to meet the specific needs of clients, investors, lenders, and internal management. These reports go beyond basic financial statements, offering insights into project profitability, cost breakdowns, budget adherence, and cash flow.

The ability to present this information in an easily digestible format is crucial for building trust, securing further investment, and demonstrating project success. QuickBooks offers pre-built reports that can be adapted, and also allows for the creation of custom reports tailored to unique project requirements.Key reports that are particularly valuable for project stakeholders include:

- Project Profitability Reports: These reports show the revenue generated by a specific project against its direct costs, highlighting the net profit or loss. This is often the most critical metric for investors and management.

- Job Cost Reports: These reports provide a detailed breakdown of all costs associated with a particular project, categorized by labor, materials, subcontractors, and other expenses. This helps stakeholders understand where the money is being spent.

- Budget vs. Actual Reports: As discussed earlier, these reports are essential for demonstrating financial control and identifying any variances from the planned budget. They show how effectively project funds are being managed.

- Accounts Receivable Aging Reports: For projects with milestone payments or long payment terms, this report is vital for understanding outstanding invoices and managing cash flow. It shows which clients owe money and for how long.

- Statement of Cash Flows: While a broader financial statement, a project-specific cash flow analysis can be generated to show the movement of cash in and out related to a particular project, crucial for liquidity planning.

When generating these reports, consider the audience. A client might be most interested in a simplified job cost report showing only direct costs and overall project status, while an investor might require a detailed profitability analysis with variance explanations. QuickBooks allows for filtering and customization of these reports by date range, customer, project, or class, ensuring that the information presented is highly relevant.

For example, to show a client the progress and costs of their specific build, you would filter the Job Cost report by their customer name and select the relevant project. You can also add columns for budgeted amounts and variance percentages to provide a more complete picture. The ability to export these reports to formats like Excel or PDF makes them easy to share and integrate into presentations.

“The clarity of financial reporting is directly proportional to the confidence of stakeholders.”

Enhance your insight with the methods and methods of accounting and business management software.

By consistently generating and distributing comprehensive financial summaries, businesses using QuickBooks for project accounting can foster transparency, build strong relationships with their stakeholders, and ultimately drive the success of their projects through informed financial stewardship.

Exploring the integration of QuickBooks project accounting with other business tools is essential for a holistic view.

Integrating QuickBooks project accounting with other essential business tools moves beyond simple financial tracking, creating a unified ecosystem that enhances operational efficiency and provides a comprehensive overview of project performance. This integration allows for seamless data flow, reducing manual entry, minimizing errors, and ultimately leading to more informed decision-making. By connecting different facets of your business, you can gain deeper insights into profitability, resource allocation, and client satisfaction, all stemming from a single, well-connected platform.The true power of QuickBooks project accounting is amplified when it communicates with other specialized software.

This synergy ensures that every piece of data, from initial client contact to final invoice, contributes to a complete financial picture. It’s about building bridges between departments and functions, so that project managers, sales teams, and finance departments are all working with the same, up-to-date information. This interconnectedness is not just a convenience; it’s a strategic imperative for businesses aiming for growth and sustained success in today’s competitive landscape.

Syncing QuickBooks Project Accounting with Time-Tracking Applications for Accurate Labor Cost Allocation

Accurate labor cost allocation is a cornerstone of profitable project accounting, and its integration with time-tracking applications is paramount. When time-tracking software is directly linked to QuickBooks, every hour logged by an employee on a specific project is automatically captured and translated into a labor cost. This eliminates the often error-prone process of manual timesheet compilation and data entry into QuickBooks.

Employees simply record their time against specific project codes or tasks within their time-tracking tool, and this information is then seamlessly pushed to QuickBooks, assigning the corresponding labor costs to the correct project.This direct synchronization ensures that project managers have real-time visibility into labor expenses. They can see, at any given moment, how much has been spent on personnel for a particular project, allowing for immediate adjustments if costs are trending higher than anticipated.

For instance, if a project involves an hourly consultant, their logged hours directly translate into billable or non-billable costs within QuickBooks, ensuring that the project’s profitability is accurately reflected. Furthermore, this integration facilitates more precise job costing. By knowing the exact labor hours and associated rates for each task within a project, businesses can better understand the true cost of delivering a project, which is crucial for accurate bidding on future work and for identifying areas where efficiency can be improved.

The ability to track time against specific phases or deliverables within a project also allows for granular analysis of labor productivity. This data can inform performance reviews, identify training needs, and optimize team assignments.The benefits extend to payroll processing as well. When time-tracking data is integrated, payroll can be generated more efficiently and accurately, as the system already has the verified hours and rates.

This reduces the likelihood of payroll errors and ensures that employees are paid correctly and on time, further contributing to overall employee satisfaction and operational smoothness. This level of detail is invaluable for businesses that rely heavily on billable hours, as it directly impacts revenue recognition and the ability to manage cash flow effectively. Without this integration, the risk of under-billing or over-billing, and the subsequent financial discrepancies, significantly increases.

Benefits of Connecting QuickBooks to CRM Systems to Link Project Financials with Client Interactions

Connecting QuickBooks project accounting to Customer Relationship Management (CRM) systems offers a powerful synergy, bridging the gap between client interactions and project financials. This integration allows for a more holistic understanding of client relationships by linking sales opportunities, client communications, and project profitability within a unified view. When a CRM system is integrated with QuickBooks, project data can be directly associated with specific clients and their associated sales records.

This means that project managers and finance teams can see not only the financial status of a project but also its history within the client relationship, including initial proposals, contract details, and any communications that may have influenced project scope or budget.One of the primary benefits is enhanced client billing and invoicing accuracy. When project milestones or deliverables are marked as complete in the CRM or project management module, this can trigger invoicing within QuickBooks.

This automation reduces manual data entry and the potential for human error, ensuring that clients are billed promptly and accurately for completed work. For example, if a CRM system tracks the progress of a web development project, marking a specific design phase as approved by the client could automatically generate a progress invoice in QuickBooks for that phase’s value. This ensures that revenue is recognized in a timely manner and that cash flow is optimized.Furthermore, this integration provides invaluable insights into client profitability.

Learn about more about the process of best ap automation software for small business in the field.

By analyzing project costs against revenue for each client, businesses can identify their most valuable clients and tailor their services accordingly. This data can inform sales strategies, helping to focus efforts on clients who are both profitable and engaged. For instance, a business might discover through integrated reporting that certain types of projects for specific client industries consistently yield higher profit margins.

This insight can then guide their marketing and sales efforts to target similar opportunities. The ability to view a client’s entire financial history with the company, from initial lead to completed projects and ongoing support, in one place provides a comprehensive picture that is essential for strategic account management and fostering long-term client loyalty. This interconnectedness allows for proactive problem-solving, as any potential issues with project profitability can be flagged early, allowing for timely intervention and communication with the client.

Comparing the Advantages of Using QuickBooks’ Native Project Accounting Features Versus Employing Third-Party Add-ons for More Specialized Needs

QuickBooks offers robust native project accounting features that cater to a wide range of small to medium-sized businesses. These built-in capabilities, such as job costing, expense tracking by project, and basic reporting, provide a solid foundation for managing project finances. The primary advantage of using QuickBooks’ native features is their seamless integration with the core accounting functions. Data flows effortlessly between general ledger, accounts payable, accounts receivable, and project-specific entries, minimizing the learning curve and ensuring consistency.

For businesses with straightforward project accounting needs, such as tracking direct costs and revenues for a limited number of projects, these native tools are often sufficient and cost-effective. The user interface is familiar to QuickBooks users, and the setup is generally less complex compared to implementing third-party solutions.However, as businesses grow and their project management complexities increase, the native features may reach their limitations.

This is where third-party add-ons become indispensable. These specialized applications are designed to extend QuickBooks’ functionality, offering advanced features for more intricate project accounting requirements. For example, if a business needs sophisticated resource management, Gantt chart scheduling, complex billing methodologies like progress billing with retainage, or detailed inventory management tied to specific projects, a third-party add-on is likely the better choice.

These add-ons often provide more granular control over project phases, task management, change order tracking, and advanced reporting capabilities that go beyond what QuickBooks’ native features can offer.The decision between native features and third-party add-ons hinges on the specific needs of the business. For a construction company managing multiple complex projects with diverse subcontractors and material costs, a specialized construction accounting add-on for QuickBooks might offer essential features like job cost reporting by cost code, union payroll integration, and lien waiver tracking.

Conversely, a small consulting firm with simple project structures might find QuickBooks’ native project profitability reports perfectly adequate. It’s a matter of matching the software’s capabilities to the business’s operational demands. While native features offer simplicity and cost-effectiveness for basic needs, third-party add-ons provide the depth and customization required for more advanced project accounting and management.

Key Considerations When Choosing Integration Partners for QuickBooks Project Accounting Solutions

Selecting the right integration partners for QuickBooks project accounting solutions is a critical decision that can significantly impact operational efficiency and financial accuracy. Several key considerations should guide this selection process to ensure a successful and sustainable integration. Firstly, compatibility and reliability are paramount. The chosen partner’s solution must be fully compatible with your specific version of QuickBooks (Desktop or Online) and demonstrate a proven track record of stable performance.

It’s essential to verify that the integration is robust and minimizes the risk of data corruption or synchronization errors. Researching reviews, case studies, and asking for references from existing users of the integration partner’s solution can provide valuable insights into its reliability.Secondly, scalability and future-proofing are crucial. As your business grows and your project accounting needs evolve, the integration solution should be able to scale with you.

This means the partner should offer different tiers of service or modules that can be added as your requirements become more complex. Consider whether the integration partner is actively developing their solution and keeping pace with QuickBooks updates and industry best practices. A solution that can adapt to future changes will save you from the costly process of re-integrating or switching partners down the line.Thirdly, support and expertise are vital.

Integrating business systems can be complex, and having access to responsive and knowledgeable support is essential. Look for integration partners who offer comprehensive support channels, including phone, email, and chat, and who have a deep understanding of both QuickBooks and the specific business processes you aim to integrate. Their expertise should extend to providing guidance on best practices for data management and workflow optimization.

Finally, security and data privacy must be a top priority. When integrating systems, sensitive financial data is being shared. Ensure that the integration partner adheres to stringent security protocols and complies with relevant data privacy regulations. Understanding how data is encrypted, stored, and accessed will provide peace of mind and protect your business from potential security breaches.

Common Challenges in QuickBooks Project Accounting and Their Resolutions

Implementing QuickBooks for project accounting, while offering numerous benefits, is not without its hurdles. Organizations often face common challenges that can impact the accuracy and effectiveness of their project financial management. Addressing these issues proactively is key to unlocking the full potential of QuickBooks for project-specific financial tracking. This section delves into these prevalent difficulties and provides practical, actionable solutions to ensure robust project accounting.

Overcoming Data Entry Errors to Ensure Project Financial Data Accuracy

Data entry errors are a pervasive threat to the integrity of any financial system, and QuickBooks project accounting is no exception. Inaccurate or incomplete data can lead to skewed project profitability reports, incorrect budget vs. actual comparisons, and ultimately, flawed decision-making. The ripple effect of a single erroneous entry can be significant, impacting everything from client billing to resource allocation.

Therefore, establishing robust protocols for data entry is paramount. This involves a multi-pronged approach focusing on standardization, validation, and continuous monitoring.One of the most effective ways to combat data entry errors is through the diligent use of item lists and customer/job profiles within QuickBooks. Ensuring that all billable services, expenses, and materials are pre-defined as items with appropriate descriptions and default accounts significantly reduces the chances of miscategorization or typos.

Similarly, setting up each project as a distinct customer or job, with all associated transactions linked to it, provides a clear audit trail. Training users to always select the correct item and job for every transaction is crucial. Beyond setup, implementing mandatory fields for critical information, such as project codes or phases, can prevent incomplete entries.Regular reconciliation is another vital step.

Just as bank accounts are reconciled, project-specific accounts and transactions should be reviewed periodically. This involves comparing QuickBooks entries against source documents like invoices, receipts, and timesheets. Discrepancies identified during reconciliation can pinpoint specific data entry errors that need correction. Furthermore, leveraging QuickBooks’ reporting features can help flag potential issues. For instance, running reports on unbilled time and expenses, or expense accounts with unusually high or low balances for a specific project, can highlight areas requiring closer inspection.Automating data entry where possible can also significantly reduce human error.

Integrating QuickBooks with other systems, such as time-tracking software or invoicing platforms, can pull data directly into QuickBooks, minimizing manual input. For transactions that must be entered manually, implementing a peer review process, where a second individual reviews a sample of entries, can catch errors before they propagate. Finally, fostering a culture of data accuracy, where team members understand the importance of precise data for project success, encourages diligence.

Clear guidelines, ongoing training, and prompt correction of any identified errors reinforce this culture.

Strategies for Ensuring Accurate Cost Categorization with Shared Resources

When multiple projects rely on the same resources – be it personnel, equipment, or shared overhead expenses – accurately categorizing costs becomes a complex challenge in QuickBooks. Without a clear system, expenses can be misallocated, leading to inaccurate project profitability assessments and potentially unfair cost distribution among projects. The key is to establish a transparent and consistent methodology for tracking and assigning these shared costs.

This requires careful planning, leveraging QuickBooks’ features effectively, and disciplined execution.A foundational strategy is the meticulous setup of QuickBooks’ chart of accounts and item lists to accommodate shared resources. For personnel costs, implementing a robust time-tracking system that allows employees to allocate their hours to specific projects is non-negotiable. This data then flows into QuickBooks, ensuring that labor costs are directly attributable.

For shared equipment or materials, creating specific “job costs” or “expense items” within QuickBooks that can be linked to the relevant projects is essential. When a resource is used across multiple projects, a predetermined allocation method must be established. This could be based on usage hours, square footage, or any other logical metric.For overhead expenses that benefit multiple projects (e.g., rent, utilities, administrative salaries), QuickBooks allows for the creation of “overhead allocation” entries.

This involves calculating the total overhead for a period and then distributing it across projects based on a defined formula. For instance, if 40% of an employee’s time is dedicated to Project A, then 40% of their salary, which is an overhead cost, can be allocated to Project A. This allocation can be done through journal entries or by using specific overhead allocation features if available in advanced QuickBooks versions or through third-party integrations.

It’s crucial that the allocation basis is documented and consistently applied.Regular review and reconciliation of cost allocations are vital to maintain accuracy. This means periodically comparing the allocated costs in QuickBooks against actual overhead expenditures and usage logs for shared resources. Any significant deviations should be investigated and adjusted. Furthermore, clear documentation of the allocation methodology is essential for transparency and auditability.

This documentation should be readily accessible to all team members involved in project accounting. Training project managers and accounting staff on how to interpret and utilize these allocated costs is also important. They need to understand that these figures represent a fair share of the overall business costs, not just direct expenses. By implementing these strategies, organizations can achieve a more accurate and equitable distribution of shared costs, leading to better project financial insights.

Methods for Training Team Members on Proper QuickBooks Project Accounting Workflows

Effective training is the bedrock of successful QuickBooks project accounting implementation. Without a well-trained team, even the most sophisticated setup will falter due to user error, inconsistency, and a lack of understanding of the system’s capabilities. Training must go beyond simply showing users how to enter data; it needs to instill a comprehensive understanding of project accounting principles within the QuickBooks context and the importance of adhering to established workflows.

This requires a structured, ongoing, and role-specific approach.A foundational step is to develop comprehensive training materials tailored to different user roles. This might include detailed user manuals, step-by-step guides for common tasks, and video tutorials demonstrating specific workflows. For administrative staff responsible for data entry, training should focus on accurate transaction recording, proper job and item selection, and understanding the link between source documents and QuickBooks entries.

Project managers, on the other hand, need training on how to interpret project reports, track budgets, manage change orders within QuickBooks, and understand the financial implications of their project decisions.Hands-on training sessions are invaluable. These sessions should be interactive, allowing participants to practice using QuickBooks in a simulated environment or with dummy data. This provides a safe space to make mistakes and learn from them without impacting live project financials.

Incorporating real-world scenarios and case studies relevant to the organization’s projects makes the training more engaging and practical. For instance, demonstrating how to record a specific type of project expense or how to generate a project profitability report for a recently completed project can be highly effective.Ongoing training and support are critical. Initial training is only the first step. As QuickBooks is updated, new features are introduced, or organizational processes evolve, refresher courses and advanced training sessions should be offered.

Establishing a clear point of contact for users who have questions or encounter issues is also essential. This could be an internal QuickBooks expert, a dedicated support person, or a designated team lead. Implementing a “buddy system” where more experienced users can mentor newer ones can also foster knowledge sharing and provide immediate assistance.Finally, reinforcing the importance of proper QuickBooks usage through regular communication and performance feedback is key.

Regularly highlight the benefits of accurate project accounting, such as improved profitability and better client relationships. When team members understand the “why” behind the workflows, they are more likely to adhere to them. This consistent reinforcement, combined with practical, role-specific training, ensures that the team can effectively leverage QuickBooks for robust project accounting.

Do not overlook explore the latest data about erp system for supply chain management.

Guidance on Performing Regular Audits of Project Accounting Data within QuickBooks

Maintaining the integrity of project accounting data within QuickBooks requires a proactive and systematic approach to auditing. Regular audits serve as a crucial quality control mechanism, identifying discrepancies, errors, and potential areas of fraud before they can have a significant negative impact on project financials or overall business operations. These audits should not be viewed as a punitive measure, but rather as an essential component of sound financial management and risk mitigation.The audit process should begin with a clear audit plan, outlining the scope, objectives, and frequency of the audits.